If I develop a chronic illness, can I use a Special Enrollment Period to join a Medicare Advantage Special Needs Plan?

Yes. If you have or develop one of Medicare's defined severe or disabling chronic conditions (see chart below), you will be granted a Special Enrollment Period (SEP) to join a Medicare Advantage Special Needs Plan (SNP) designed to serve people with the specific condition. You can use the one-time SEP during the plan year with coverage starting on the first day of the month after your enrollment.

As noted by Medicare, the Centers for Medicare and Medicaid Services (CMS):

As noted by Medicare, the Centers for Medicare and Medicaid Services (CMS):

"CMS will provide [a Special Enrollment Period (SEP)] for those individuals with severe or disabling chronic conditions to enroll in a [Medicare Advantage Special Needs Plan (SNP)] designed to serve individuals with those conditions. This SEP is available while the individual has the qualifying condition(s); it ends upon enrollment in the chronic care SNP.

Once the SEP ends, that individual may make enrollment changes only during applicable MA election periods [such as the AEP and MA-OEP].

In addition, individuals enrolled in a Chronic Care SNP who have a severe/disabling chronic condition which is not a focus of their current SNP are eligible for this SEP. Such individuals have an opportunity to enroll in a Chronic Care SNP that focuses on this other condition. Eligibility for this SEP ends at the time the individual enrolls in the new SNP." [formatting and links added]

Annual Changes in the SNP Landscape

The number and type of Medicare Advantage Special Needs Plans usually changes every year - so be sure to check the availability of different Chronic Care SNPs in your area. Here is an example list of Chronic Care SNPs (C-SNPs) showing the changes and availability from the previous year. You can also read more in our article: Significant changes in the 2023 Medicare Advantage Special Needs Plan (SNP) landscape

| 2023 Special Needs – Chronic Care Plans Compared to the 2021 Plan Year |

|||||

| Chronic Care | Number of SNPs | ||||

| 2023 Plans | 2022 Plans | Net Change | 2021 Plans | 2020 Plans | |

| Cardiovascular Disorders | 1 | 1 | 0 | 1 | 0 |

| Cardiovascular Disorders and Chronic Heart Failure | 22 | 20 | 2 | 14 | 10 |

| Cardiovascular Disorders and Diabetes | 5 | 4 | 1 | 6 | 2 |

| Cardiovascular Disorders, Chronic Heart Failure and Diabetes | 164 | 141 | 23 | 93 | 67 |

| Chronic and Disabling Mental Health Conditions | 2 | 5 | -3 | 3 | 2 |

| Cardiovascular Disorders or Chronic Heart Failure or Diabetes Mellitus | 5 | 3 | 2 | 3 | 2 |

| Chronic Heart Failure | 3 | 3 | 0 | 3 | 1 |

| Chronic Heart Failure and Diabetes | 2 | 4 | -2 | 3 | 6 |

| Chronic Lung Disorders | 35 | 29 | 6 | 23 | 16 |

| Dementia | 6 | 8 | -2 | 7 | 8 |

| Diabetes Mellitus | 36 | 34 | 2 | 34 | 37 |

| End-stage Renal Disease Requiring Dialysis (any mode of dialysis) | 23 | 17 | 6 | 9 | 10 |

| End-stage Renal Disease Requiring Dialysis or HIV/AIDS | 3 | 3 | 0 | 0 | 0 |

| HIV/AIDS | 3 | 3 | 0 | 4 | 4 |

| Total Chronic Illness SNPs | 310 | 275 | 35 | 203 | 165 |

Seeing the Medicare Advantage Chronic Condition Special Needs Plans (C-SNPs) in your area.

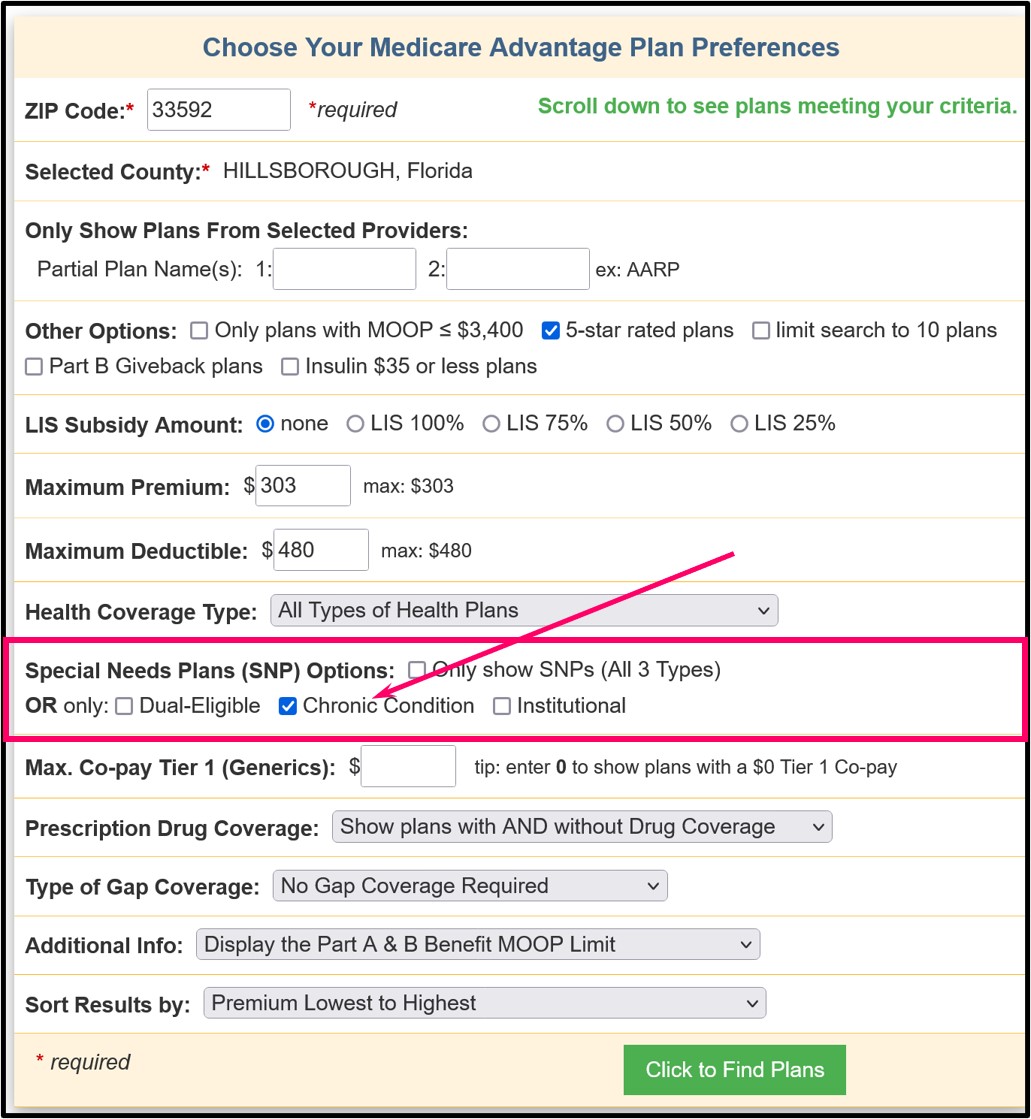

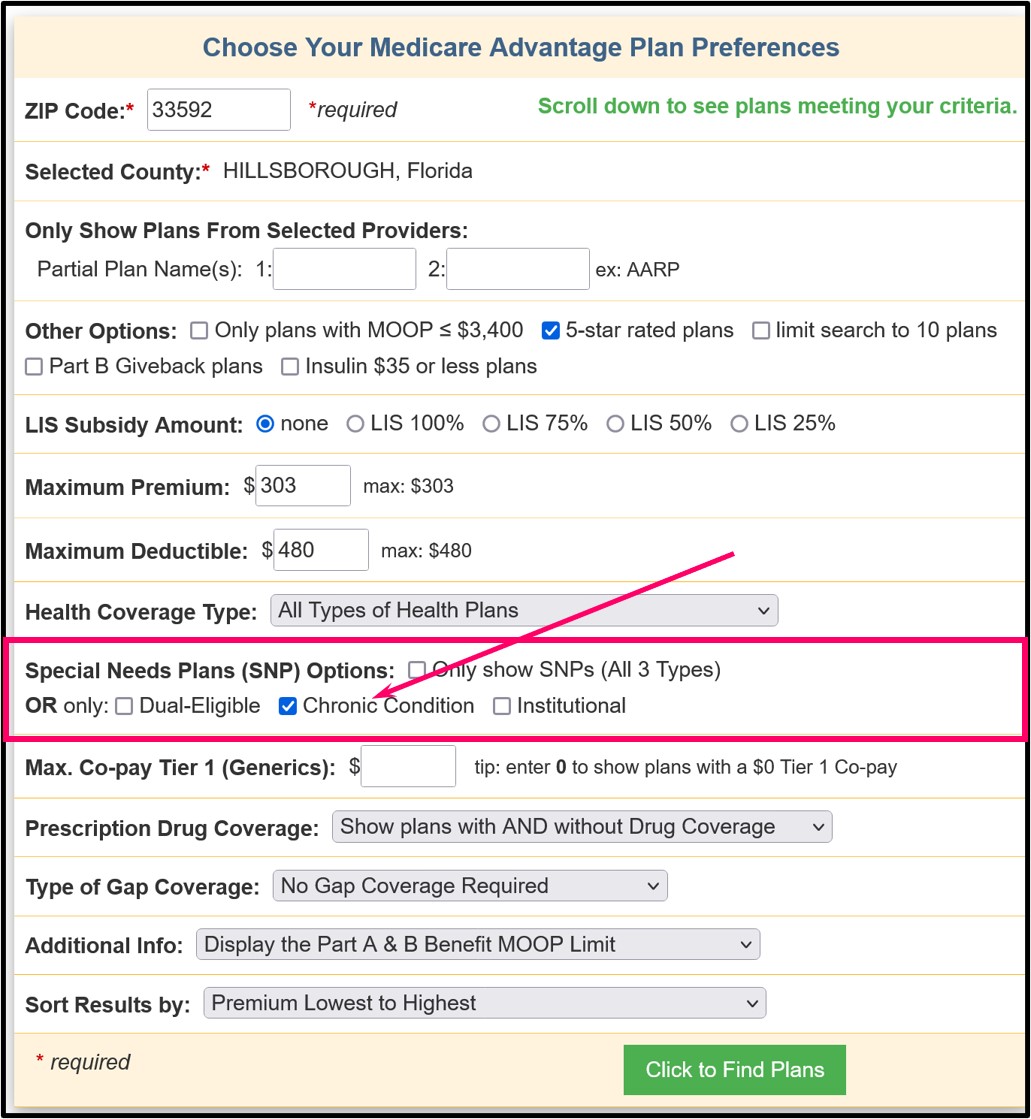

You can use our Medicare Advantage Plan Finder (MA-Finder.com) to see all Medicare Advantage plans in a specific Service Area (ZIP Code area). As an example, you can begin with Medicare Advantage plans in HILLSBOROUGH County, Florida at MA-FInder.com/33592. Then you can choose the Special Needs Plan filter in the search criteria area to see only specific Special Needs Plans, such as Chronic Care SNPs.

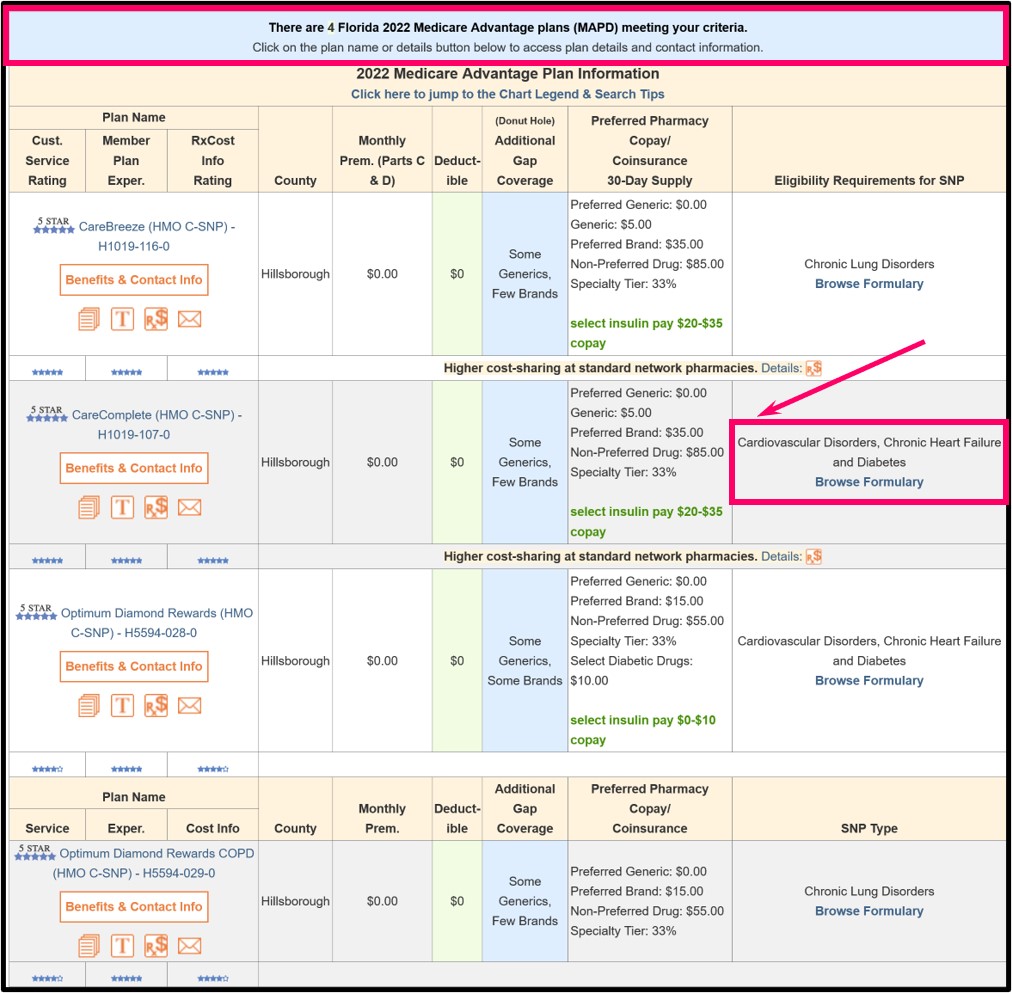

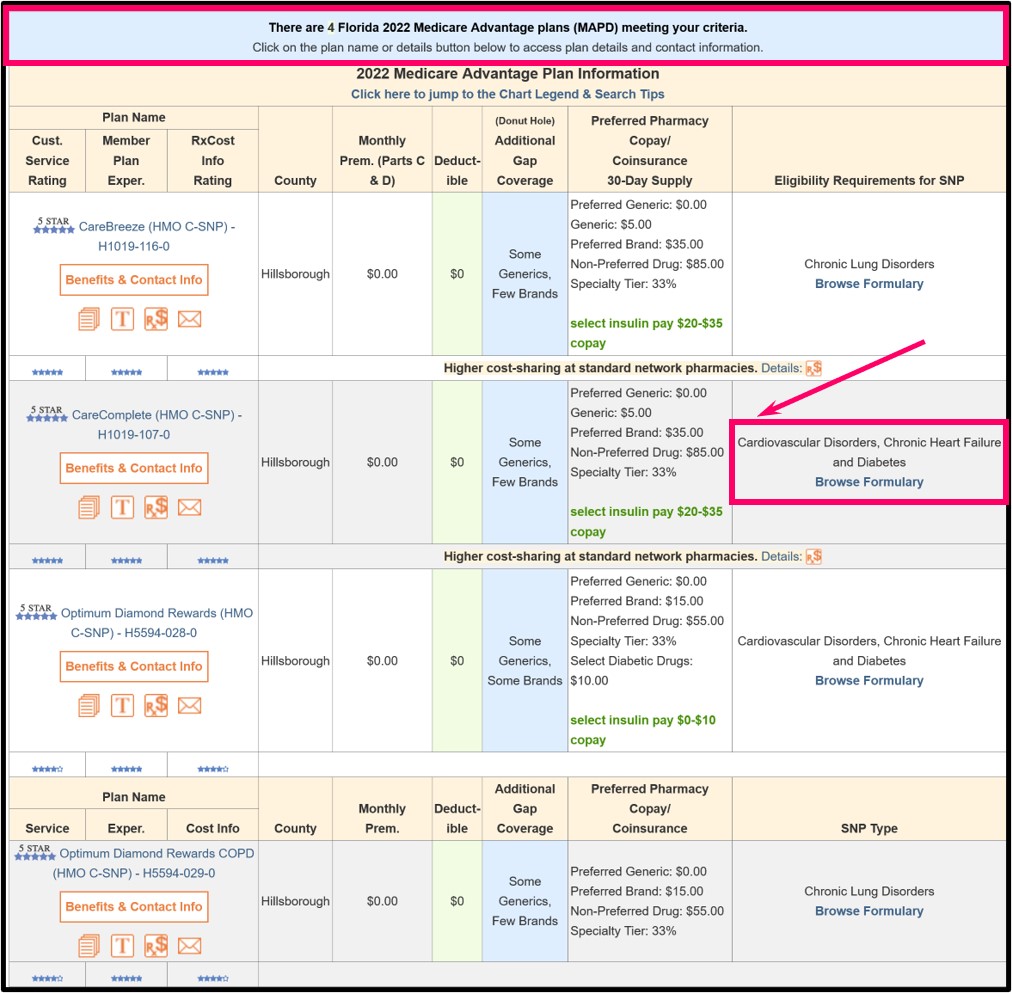

When you search using this C-SNP filter, you will see the C-SNPs available in the county along with the "Chronic condition(s)" under the right-most column heading "Eligibility Requirements for SNP" and text such as "Cardiovascular Disorders, Chronic Heart Failure and Diabetes" that the Medicare Advantage plan was designed to meet.

And when your health improves and you no longer meet the Chronic Condition requirement . . .

As a reminder, if your health should improve or you do not show the qualifying chronic condition and longer qualify for the Special Needs Plan, CMS will provide you with an SEP to join another Medicare Advantage plan in your area.

Reference:

Medicare Managed Care Manual, Chapter 2 - Medicare Advantage Enrollment and Disenrollment, Updated: August 19, 2011 (Revised: November 16, 2011, August 7, 2012, August 30, 2013, August 14, 2014, July 6, 2015, September 1, 2015, September 14, 2015, December 30, 2015,May 27, 2016, August 25, 2016, June 15, 2017, July 31, 2018& August 12, 2020), p.44

You can use our Medicare Advantage Plan Finder (MA-Finder.com) to see all Medicare Advantage plans in a specific Service Area (ZIP Code area). As an example, you can begin with Medicare Advantage plans in HILLSBOROUGH County, Florida at MA-FInder.com/33592. Then you can choose the Special Needs Plan filter in the search criteria area to see only specific Special Needs Plans, such as Chronic Care SNPs.

When you search using this C-SNP filter, you will see the C-SNPs available in the county along with the "Chronic condition(s)" under the right-most column heading "Eligibility Requirements for SNP" and text such as "Cardiovascular Disorders, Chronic Heart Failure and Diabetes" that the Medicare Advantage plan was designed to meet.

And when your health improves and you no longer meet the Chronic Condition requirement . . .

As a reminder, if your health should improve or you do not show the qualifying chronic condition and longer qualify for the Special Needs Plan, CMS will provide you with an SEP to join another Medicare Advantage plan in your area.

Reference:

Medicare Managed Care Manual, Chapter 2 - Medicare Advantage Enrollment and Disenrollment, Updated: August 19, 2011 (Revised: November 16, 2011, August 7, 2012, August 30, 2013, August 14, 2014, July 6, 2015, September 1, 2015, September 14, 2015, December 30, 2015,May 27, 2016, August 25, 2016, June 15, 2017, July 31, 2018& August 12, 2020), p.44

Browse FAQ Categories

Could You Save Using a Drug Discount Card?

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service