Catastrophic Coverage 2005 through 2023

Medicare Part D Catastrophic Coverage is the fourth and final part of your Medicare Part D prescription drug plan coverage and is designed to help reduce the out-of-pocket spending for people with high drug costs. In short, once you spend over a certain amount of money each year, your formulary drug costs will be limited to no more than 5% of retail.

For example, after you spend over $7,400 out-of-pocket in 2023, you will meet your Medicare Part D prescription drug plan's out-of-pocket spending limit (TrOOP), exit the Coverage Gap or Donut Hole phase of your Medicare drug plan, and enter the Catastrophic Coverage phase - you will stay in this final part of your Medicare Part D prescription drug plan coverage for the remainder of the year (through December 31).

Approximately 1.5 million people (who do not qualify for the Part D Low-Income Subsidy) reach the Catastrophic Coverage phase of their Medicare Part D coverage - and although they will pay no more than 5% of retail drug prices, out-of-pocket costs can be significant due to the use of very high-priced prescription drugs.

Question: So, once I reach 2023 Catastrophic Coverage, will I pay less for my formulary drugs?

Most likely, yes. Once you reach Catastrophic Coverage, your formulary drug costs (for brand-name and generics) should be significantly reduced for the remainder of the year.

The only rare exception might be when your Medicare Part D plan offers supplemental Donut Hole Coverage and your Donut Hole costs are less than 5% of your drug's retail price. For example, if you are using a drug with a $1,000 retail price and your Part D drug plans provides coverage in the Gap at $47, you will be paying more when you reach Catastrophic Coverage since you will pay 5% of retail or $50 (5% of $1,000).

In the Catastrophic Coverage phase, you will pay the greater of either 5% of the formulary drug's retail price or a fixed copay (that is set annually) depending on the type of drug -- generics and preferred brand drugs that are multi-source drugs or all other brand-name drugs.

For example, in 2023, you pay the higher of either 5% of retail prices or $10.35 for brands or $4.15 for generics in Catastrophic Coverage.

As another example, if you are using a single-source, brand drug with a $500 retail price, you would pay 5% of retail or $25 (5% of $500 = $25), since $25 is higher than $10.35.

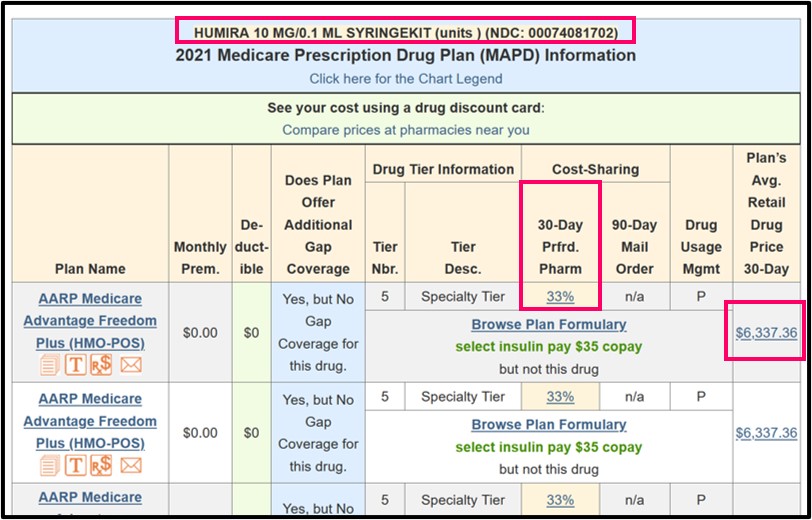

As another example below shows, a popular Medicare Part D drug with a high retail price (assume $6,000), might cost 33% of retail during the Initial Coverage Phase (about $1,980), 25% of retail in the Coverage Gap or Donut Hole ($1,500), and 5% of retail in Catastrophic Coverage ($300).

Question: Can I choose a Medicare Part D plan with lower or better Catastrophic Coverage?

No, but you can choose a plan with lower retail drug prices. Catastrophic Coverage cost-sharing is the same for all Medicare Part D plans - but, Medicare plans will have different retail drug prices that can affect your drug costs in the Catastrophic Coverage phase.

For more information, please see our FAQ: Can I choose a Medicare Part D plan with better Catastrophic Coverage?

Question: Do Catastrophic Coverage costs change over the years.

Yes, usually costs are increasing. As noted, in the Catastrophic Coverage phase you will pay the greater of the fixed annual copay (for brands or generics) or 5% of the formulary drug's negotiated retail price - so, as retail drug prices increase, so also can your Catastrophic Coverage costs increase.

For example, if you are using a brand-name drug with a retail cost of $100, your coverage cost in the 2023 Catastrophic Coverage phase would be $10.35 (since $10.35 is greater than $5 - or 5% of $100). But, if you were using a brand drug that now has a $400 retail cost you would pay $20 (since $20 - or 5% of $400 is greater than the standard 2023 copay of $10.35).

Keep in mind that 2023 is the last year that Medicare Part D beneficiaries will pay cost-sharing in the Catastrophic Coverage phase. For plan year 2024, the Inflation Reduction Act (IRA) of 2022 eliminates beneficiary cost-sharing in the Catastrophic Coverage phase.

For more information, please see our FAQ: Will my Catastrophic Coverage drug costs change over the years?

You can also click here to see a chart of Medicare Part D plan parameters for all years since 2006.

Question: What should I do if I use a non-formulary drug and have reached Catastrophic Coverage?

Pay full retail cost and ask your plan to cover the medication. As noted, your low-cost Catastrophic Coverage copayments are only for your formulary drugs. If you are using a non-formulary drug, you would not receive the low cost sharing and will, instead, pay the full retail drug cost.

Therefore, if you reach the Catastrophic Coverage phase, and you begin using a non-formulary medication, you may wish to file for a formulary exception to have the drug added to your Medicare Part D plan coverage so that it will be covered during all phases of your Medicare Part D coverage. Your Medicare plan does not automatically grant a formulary exception request and you may need to appeal a negative decision. If your Medicare prescription drug plan does approve your request, the medication will usually be added to the specialty drug tier.

Question: Where does Catastrophic Coverage fit into my Medicare drug plan and annual spending?

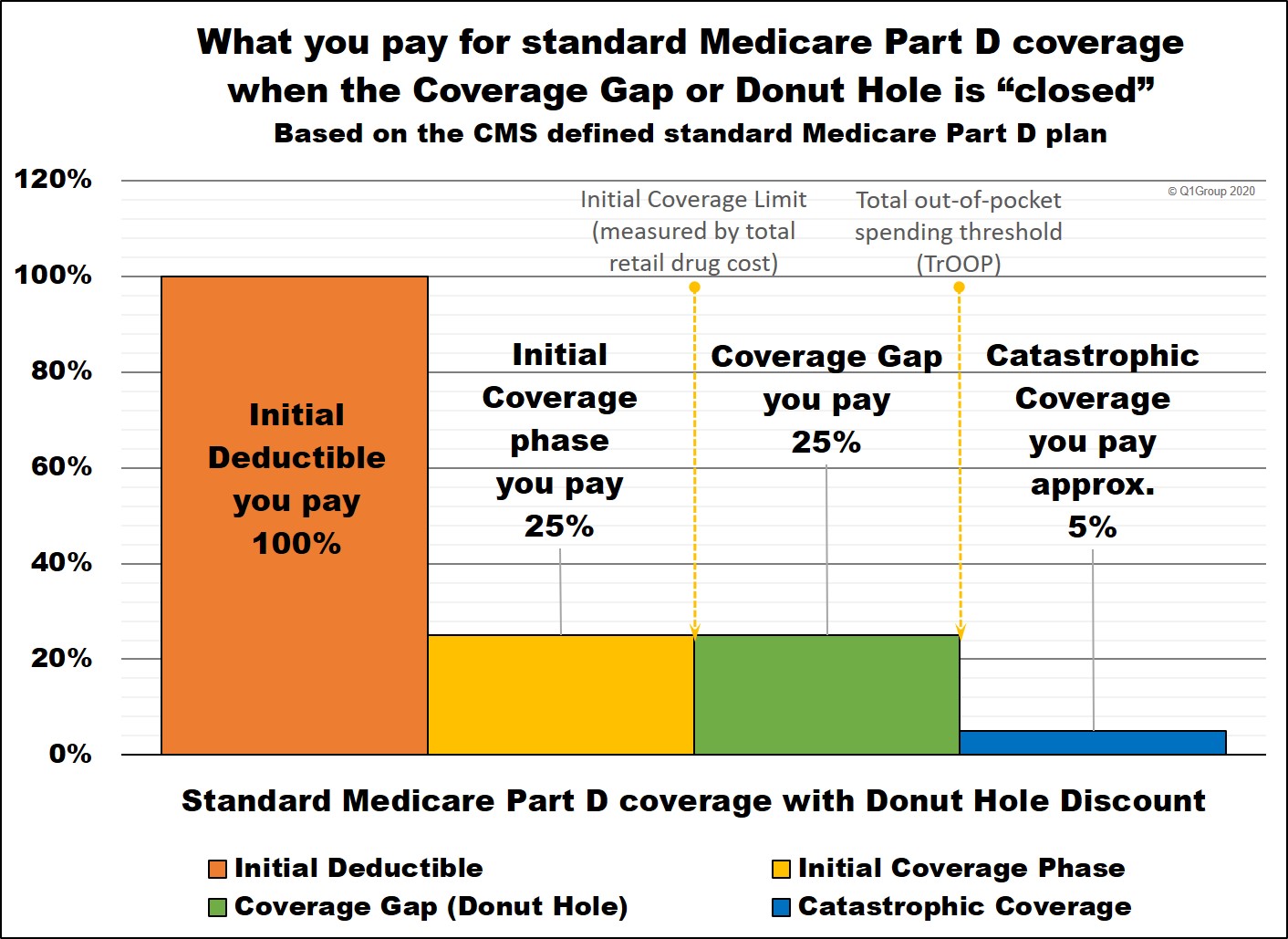

Your Medicare Part D plan will have four possible phases or parts.

(1) The Initial Deductible. If your Medicare Part D plan has an initial deductible, you will pay 100% of this amount ($505 in 2023 and $480 in 2022) (unless certain drugs are excluded from the deductible, such as Tier 1 and Tier 2 drugs).

(2) The Initial Coverage phase. After meeting your initial deductible or if your Medicare plan has a $0 deductible, you will share the cost of your drugs with your plan during this phase. Once the retail value of your drug purchases reaches a certain point ($4,660 in 2023 and $4,430 in 2022), (not what you paid, but the retail value), you will exit the Initial Coverage Phase and enter the Donut Hole or Coverage Gap.

(3) The Coverage Gap or Donut Hole. During the Donut Hole, you will receive a discount on the price of your Medicare Part D drugs until you have spent a certain amount out-of-pocket ($7,400 in 2023 and $7,050 in 2022) and then you will exit the Donut Hole and enter the Catastrophic Coverage phase.

(4) The Catastrophic Coverage phase. The fourth and final phase of your Medicare Part D plan coverage.

And to give you an overview of your Medicare Part D spending . . . our Donut Hole Calculator.

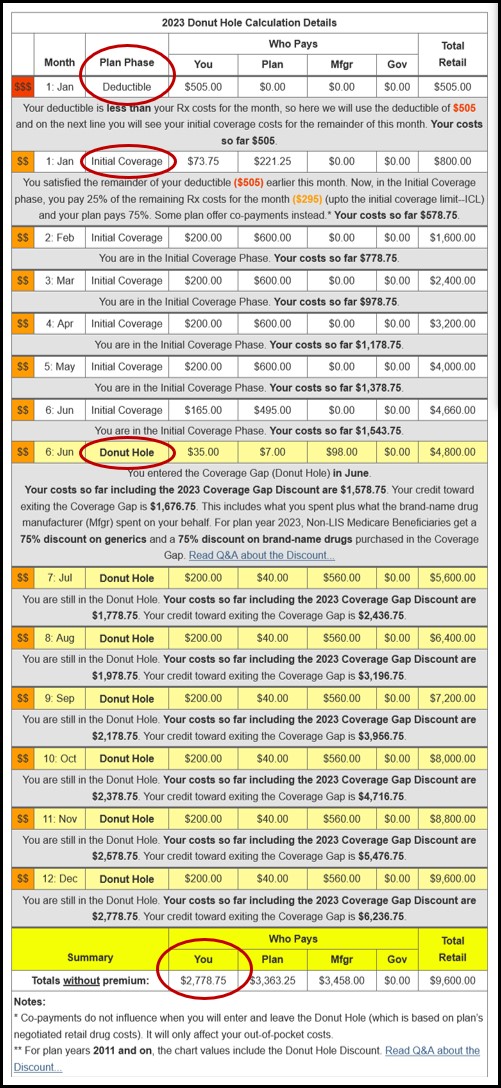

We also have several examples online to help you get started with our PDP-Planner tool. You can click here for a 2023 example of a Medicare beneficiary with relatively high monthly prescription drug costs (retail prescription drug cost of $800 per month - resulting in annual out-of-pocket drug spending of about $2,779) and then change the monthly drug cost to whatever you wish.

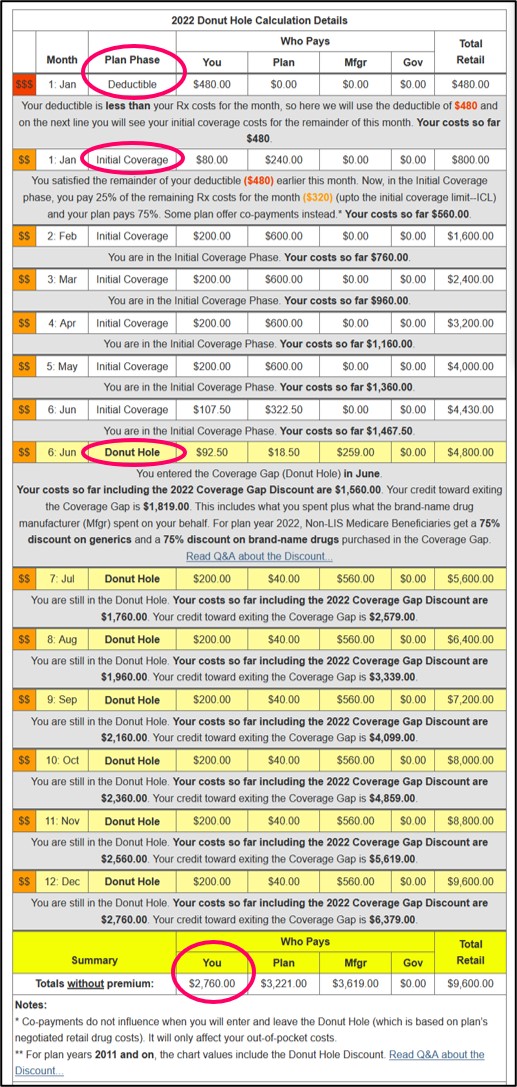

The illustration below is for the 2022 plan year, when the same $800 per month drug cost came to an annual out-of-pocket drug spending of about $2,760.

Question: So what is the minimum average monthly retail drug cost needed to enter 2023 Catastrophic Coverage?

About $934 in 2023. If your monthly retail drug costs average more than $934 in 2023, you will probably exit the Donut Hole or Coverage Gap and enter the Catastrophic Coverage phase. But, since your Medicare Part D plan will change every year, your spending to enter Catastrophic Coverage will also change.

We are estimating the retail drug cost necessary for reaching the total out-of-pocket spending threshold (TrOOP) and entering Catastrophic Coverage based on annual plan parameters and estimated spending habits during the Donut Hole. As an example, for 2023, the Centers for Medicare and Medicaid Services (CMS) estimates that most people purchase a mix of about 8% generics and 92% brand-name drugs while in the Donut Hole (and this average "mix" of brands and generics changes every year).

For more information about when (or if) you will enter Catastrophic Coverage, please see our FAQ: Can I estimate whether I will enter Catastrophic Coverage?

Question: How do my costs change throughout my 2023 Medicare drug plan coverage?

Here is how example formulary drug purchases are calculated throughout your Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide).

|

When you purchase a formulary medication |

|||||||

|

Example |

You Pay |

Your |

Drug Mfg. Pays |

U.S. |

Amount counting toward your ICL |

Amount counting toward your TrOOP |

|

|

Part 1 |

$100 |

$100 |

$0 |

$0 |

$0 |

$100 |

$100 |

|

Part 2 |

$100 |

$25 |

$75 |

$0 |

$0 |

$100 |

$25 |

|

Part 3 |

$100 |

$25 |

$5 |

$70 |

$0 |

n/a |

$25+$70 |

|

Coverage Gap - generic *** |

$100 |

$25 |

$75 |

$0 |

$0 |

n/a |

$25 |

|

Part 4 |

$200 |

$10 |

$30 |

$0 |

$160 |

n/a |

n/a |

|

Catastrophic Coverage (generic drug) **** |

$100 |

$5 |

$15 |

$0 |

$80 |

n/a |

n/a |

* 25% coinsurance

** 75% Brand-name Discount

*** 75% Generic Discount

**** you pay 5% of retail or $10.35 in 2023 for brand drugs whatever is higher or 5% of retail or $4.15 in 2023 for generic or multi-source drugs whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

"n/a" - "not applicable" to this phase or part of your Medicare Part D plan coverage

Question: What do I pay in the 2023 Catastrophic Coverage phase if I qualify for the Medicare Part D Extra Help program?

Your cost in the Catastrophic Coverage phase can vary slightly depending on your level of Extra Help - and this amount can vary year-to-year.

If you qualify for full-Extra Help or Low-Income Subsidy (LIS) benefits, you will have a $0 copay in the Catastrophic Coverage phase. However, if you receive 75% LIS benefits (between 135% and 150% of FPL), you will pay a portion on your drug costs. For example, if you reach the Catastrophic Coverage phase and you receive 75% LIS benefits, you pay $4.15 in 2023 for generic / preferred multi-source drugs and $10.35 in 2023 for all other formulary drugs.

For more information, please see our FAQ: What do I pay in Catastrophic Coverage if I qualify for Medicare Part D Extra Help or the Low-Income (LIS) program?

2023 Catastrophic Coverage costs for full- and partial LIS beneficiaries can be found online in our table Medicare Part D Standard Benefit Model Plan Parameters under the bottom section "Maximum Copayments above Out-of-Pocket Threshold".

Question: How many Medicare Part D beneficiaries actually enter into the Catastrophic Coverage phase?

About 1.5 million people in 2019 (up from 1 million in 2015). According to research published on July 23, 2021 from the Kaiser Family Foundation, about 1.5 million people in 2019 who do not qualify for the Low-Income Subsidy (LIS) entered Catastrophic Coverage. (see www.kff.org/medicare/issue-brief/millions-of-medicare-part-d- enrollees-have-had-out-of -pocket-drug-spending-above- the-catastrophic-threshold-over-time)

According to earlier research from the Kaiser Family Foundation, "3.6 million Medicare Part D enrollees had total drug spending above the catastrophic coverage threshold [in 2015]. Of this total, 2.6 million enrollees received low-income subsidies [LIS], but 1 million enrollees did not, and incurred out-of-pocket drug spending above the catastrophic threshold." [emphasis added]

(For more information, please see www.kff.org/medicare/issue-brief/no-limit-medicare-part-d-enrollees-exposed-to-high-out-of-pocket-drug-costs-without-a-hard-cap-on-spending/)

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service