You can find a link to our Donut Hole Calculator in either the right-hand margin or left-hand navigation (when using the full screed, desktop view). If you are using a smaller screen or mobile device, you can enter PDP-Planner.com.

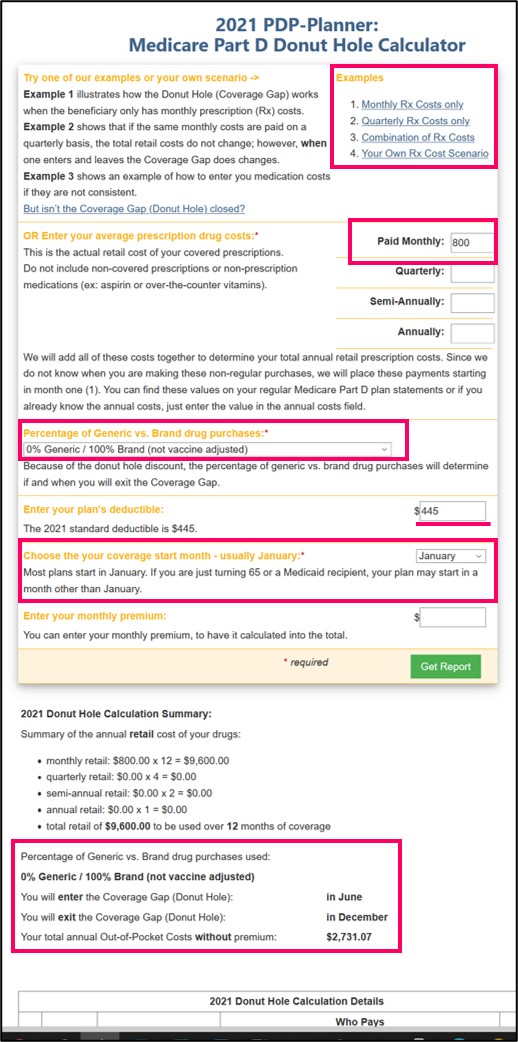

Once on the PDP-Planner / Donut Hole Calculator page, you can begin by:

(1) entering your average monthly Medicare Part D retail drug costs,

(2) choose the month when your drug plan coverage began (usually January),

(3) change your plan's Initial Deductible (if you wish), and

(4) choose your approximate mix of generic or brand-name drugs.

How do I estimate my Medicare Part D plan's retail drug prices?

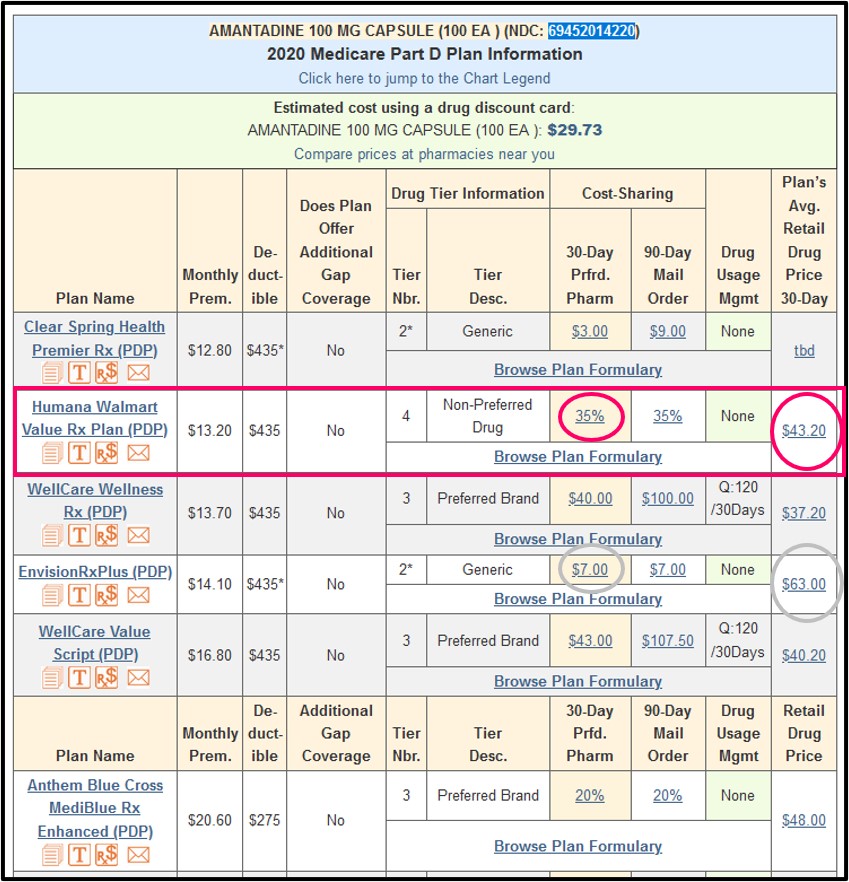

You can estimate your retail drug costs using our Q1Rx Drug Finder found at Q1Rx.com.

Just enter the name of your formulary drug, location, and see the average retail prices across all Medicare Part D drug plans in your area (standard and preferred network retail pricing can vary). Your actual retail drug costs should also be found within your plan's "Explanation of Benefits" letter that you receive every month.

Finally, click on the green "Get Report" button found at the bottom.

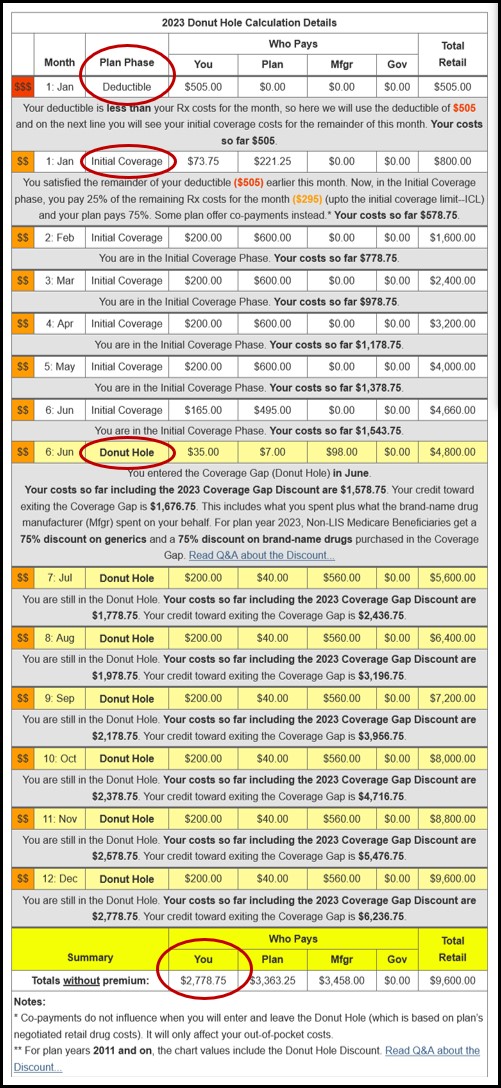

To help you visualize your potential drug spending, we show a chart of how your estimated annual drug costs are organized by month and within the four parts of your Medicare Part D plan coverage (Initial Deductible, Initial Coverage Phase, Coverage Gap (or Donut Hole), and Catastrophic Coverage). If you have a $0 deductible, you will naturally skip over the first part of coverage and begin directly in the Initial Coverage Phase.

Our PDP-Planner tool or Donut Hole Calculator uses the annual Centers for Medicare and Medicaid Services (CMS) defined standard Medicare Part D prescription drug plan benefit

parameters (assuming a 25% co-insurance as cost-sharing during the Initial Coverage Phase), the annual Donut Hole discount, and even calculates your "straddle claims"

-- drug purchases that cross over more than one drug plan coverage

phase. The results of the Donut Hole Calculator can be sent directly to

your email account, printed, or viewed online.

We even have older versions of our Donut Hole calculators online in our "Plan Archives" section if you wanted to see how your estimated Medicare Part D spending might have changed over the years.

How about an example?

To get started, we provide several Donut Hole or Coverage Gap examples with links at the top of the page. You can click here for an example of a Medicare beneficiary with relatively high monthly prescription drug costs (retail drug costs averaging $800 per month), an initial deductible of $505 (the standard 2023 deductible), and we chose to have all of the $800 drug costs are for brand-name formulary medications (0% Generic / 100% Brand).

Right under the example, you can see that this Medicare beneficiary can anticipate entering the Donut Hole or Coverage Gap in June 2023 when their Initial Coverage Limit of $4,660 is exceeded.

With monthly retail drug costs of $800, this same person can expect end the year in the 2023 Donut Hole. They will not enter the Catastrophic Coverage phase which happens when their True or total out-of-pocket costs (TrOOP) exceeds $7,400.

In our example, this person’s total annual out-of-pocket drug expenses would be approximately $2,779.

Again, we are assuming coverage began in January - and the Medicare Part D plan included the standard 25% co-insurance rate during the person's Initial Coverage Phase - and 100% of the brand drugs purchased in the Donut Hole received the 75% Donut Hole discount - with 95% of the retail drug costs during the Donut Hole applying to TrOOP.

As a summary, an overview chart shows how this person's drug costs change month-to-month based on the phases or parts of their Medicare Part D plan coverage.

If you wish, you can change the $800 value in our example to your own prescription spending - change the deductible (which is set at $0 by default) - and choose your mix of generic or brand-name drugs to see a preview of your own Medicare Part D drug coverage.

Still not sure what all these numbers mean to you or need a little extra help? No problem, click here and let us know.

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service