What is a Quantity Limitation (QL) in Medicare Part D?

A Quantity Limitation (Quantity Limit), according to the Centers for Medicare and Medicaid (CMS) is defined as:

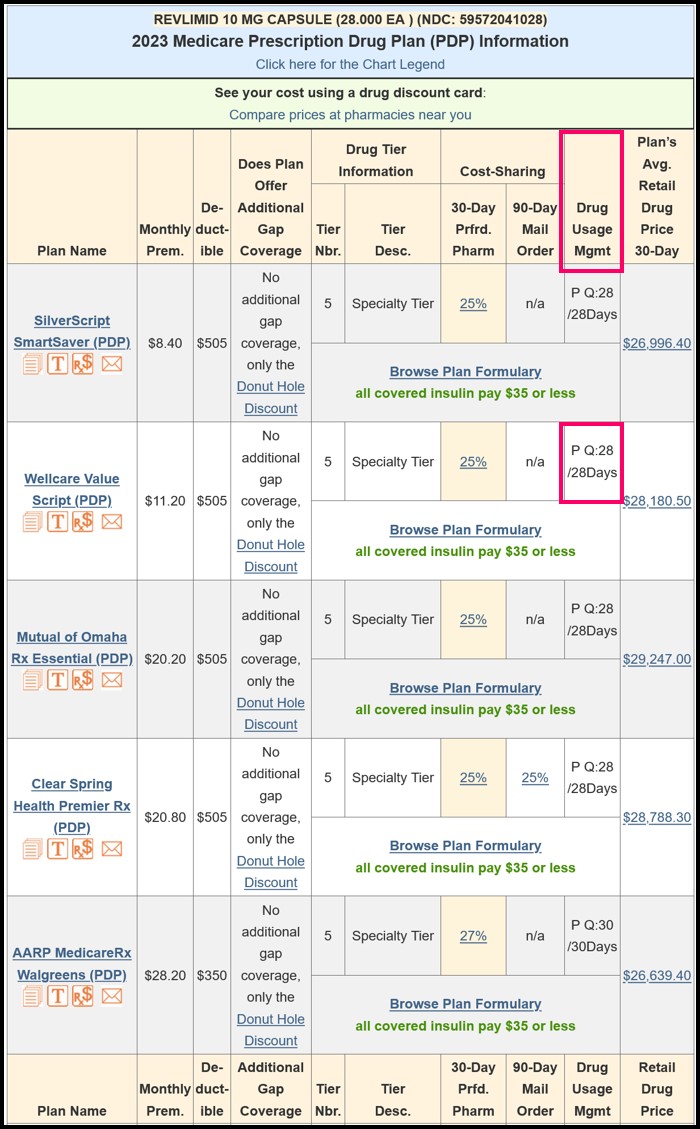

For safety and cost reasons, plans may limit the quantity of drugs that they cover over a certain period of time.Quantity Limits (QL) are usually a part of a Medicare Part D prescription drug plan's utilization management policy (also known as Usage Management Restriction or Drug Restrictions).

(source: Medicare.gov)

Even if you did not change Medicare prescription drug plans, it is possible that, starting in January, your new prescription drug plan has implemented some form of utilization management (also known as drug restrictions or drug usage management restrictions) in their formulary to keep costs down and protect their plan members.

Your Medicare Part D plan formulary will show any Quantity Limits for your medications and you can also see the Quantity Limits for all formulary medications by using our Drug Finder (Q1Rx.com).

For example: "Q:6/28Days" meaning the quantity limit is a quantity of 6 pills per 28 days or "Q:90/365Days" meaning the Medicare Part D plan limits this drug to 90 pills for the entire year.

See also:

Where do I get a list of the number of pills I can get at one time?

In general, drug restrictions or utilization management includes such prescription controls as:

- Quantity Limits (for example, only allowing plan members 30 tablets per 30 days) or

- Prior Authorization (requiring members to get plan approval before filling a prescription) or

- Step Therapy (having members try lower-costing

medications before using a more expensive drug).

Also, don't forget about asking for a transition fill.

If your medication is now subject to utilization management restrictions, you can ask your Medicare prescription drug plan for a one-time, transition fill or temporary supply of your medication for 30 days while you are filing a formulary exception request that would allow you to be exempt from the usage management restriction..

According to the Centers for Medicare and Medicaid Services (CMS) the transition fill policy will apply to non-formulary Part D drugs and includes

“Part D drugs that are on a sponsor’s formulary but require prior authorization or step therapy, or that have an approved [quantity limit] QL lower than the beneficiary’s current dose, under a plan’s utilization management requirements. This is because a formulary drug whose access is restricted via UM requirements is essentially equivalent to a non-formulary Part D drug to the extent that the relevant UM requirements are not met for a particular enrollee.”

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service