What is Step Therapy (ST) in Medicare Part D?

Step Therapy is a utilization management restriction that your Medicare Part D prescription drug plan can add to a formulary medication.

According to the Centers for Medicare and Medicaid (CMS) "Step Therapy" is defined as:

According to the Centers for Medicare and Medicaid (CMS) "Step Therapy" is defined as:

When your Medicare Part D plan requires you to first try one (usually less-expensive) drug before the drug plan will pay for coverage of another (usually more-expensive) drug for that same medical condition. For example, if Drug AA and Drug BB both treat your medical condition, your Medicare plan may require your doctor to prescribe Drug AA first. If Drug AA does not effectively treat your condition or work for you, then the plan will then cover Drug BB.(source: Medicare.gov)

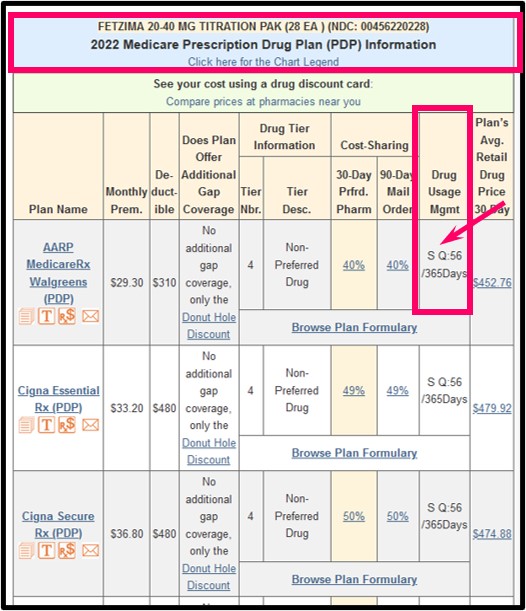

On our Medicare prescription drug finder (Q1Rx.com), we use "S" to designate that the Medicare Part D plan requires Step Therapy for a particular medication. Here is an example screen for "FETZIMA 20-40 MG TITRATION PAK (28 EA) (NDC: 00456220228)" showing that the medication has both a usage management restriction for "S" step therapy and "Q 56 / 365" or quantity limit of 56 per year.

For another example, you can click here for an example of our 2024 Drug Finder search (FANAPT 1 MG TABLET (60.000 EA) (NDC: 43068010102)) showing a medication and the plans that have various utilization management restrictions (Quantity Limits, Step Therapy, Prior Authorization - such as: S Q:60/30Days -- meaning: this medication requires Step Therapy and has a Quantity Limit of 60 per 30 days).

As reference, here is our Q1Rx.com Drug Finder "key" to Medicare Part D utilization management restrictions.

Since a formulary drug subject to Step Therapy requires you to try a less-expensive medication (or a medication on a lower-costing formulary tier) before your Medicare Part D drug plan will pay for the higher-costing formulary drug that your doctor may have originally prescribed - the downside of Step Therapy is that the trial process can take several months before that you and your doctor find that a particular medication does not work as well as another formulary medication that is subject to the Step Therapy restriction.

What to do when you have a Step Therapy restriction.

The good news is that you can avoid Step Therapy by either:

(1) choosing a Medicare Part D plan that does not have a Step Therapy restriction for your medication or

(2) you can ask your Medicare Part D plan for a Formulary Exception so that you are exempt from the Step Therapy restriction.

You can read more about the Formulary Exception process here:

q1medicare.com/PartD-DrugListExceptionAppealGrievance.php

Drug Utilization Management or Coverage Rules - (Drug Usage Mgmt)The downside of a Step Therapy restriction: The time necessary when trying alternative drugs.

- None - This drug does not fall under any drug utilization management controls.

- P - Prior Authorization -This drug is subject to prior authorization.

- S - Step Therapy -This drug is subject to step therapy.

- Q - Quantity Limits -This drug is subject to quantity limits. The actual quantity limit is shown as Q:Amount/Days. For Example: Q:6/28Days means the quantity limit is a quantity of 6 pills per 28 days. Q:90/365Days would mean that the plan limits this drug to 90 pills for the entire year.

Since a formulary drug subject to Step Therapy requires you to try a less-expensive medication (or a medication on a lower-costing formulary tier) before your Medicare Part D drug plan will pay for the higher-costing formulary drug that your doctor may have originally prescribed - the downside of Step Therapy is that the trial process can take several months before that you and your doctor find that a particular medication does not work as well as another formulary medication that is subject to the Step Therapy restriction.

What to do when you have a Step Therapy restriction.

The good news is that you can avoid Step Therapy by either:

(1) choosing a Medicare Part D plan that does not have a Step Therapy restriction for your medication or

(2) you can ask your Medicare Part D plan for a Formulary Exception so that you are exempt from the Step Therapy restriction.

You can read more about the Formulary Exception process here:

q1medicare.com/PartD-DrugListExceptionAppealGrievance.php

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service