When a Medicare drug plan states a $1 or 20% copay, is that copay the same at all pharmacies?

The answer depends on your chosen Medicare plan and whether your Medicare prescription drug plan uses preferred network pharmacy pricing. If you have preferred/standard pharmacies in your Medicare drug plan's pharmacy network - you will pay the stated co-pay or cost-sharing at preferred pharmacies and possible more at a standard network pharmacy. If the plan does not have preferred pharmacies so the cost-sharing shown in a Medicare

Part D plan’s formulary is for all network pharmacies (for example, the $1 co-pay or 20% co-insurance at any network pharmacy).

Preferred v. Standard Pharmacy Network pricing

However, most Medicare prescription drug plans have preferred pharmacy pricing, meaning you will pay less for you formulary medications at a preferred network pharmacy as compared to a non-preferred network pharmacy.

In our Medicare Part D Plan Finder (PDP-Finder.com), we indicate the drug plans that use both preferred pharmacy and the non-preferred network pharmacy pricing with the text, "Non-preferred network pharmacies have higher cost-sharing" shown below the plan details.

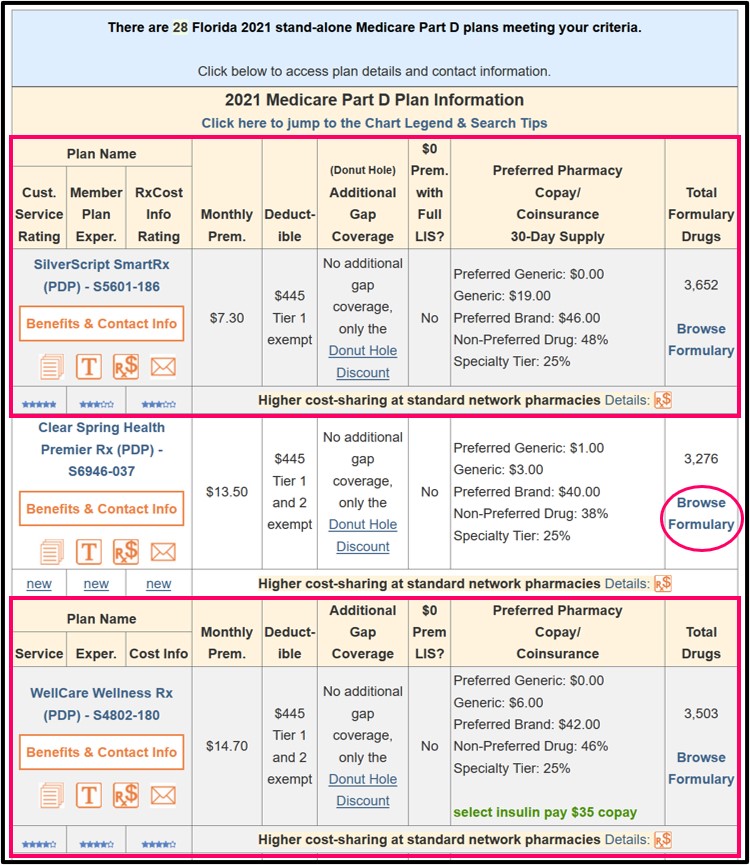

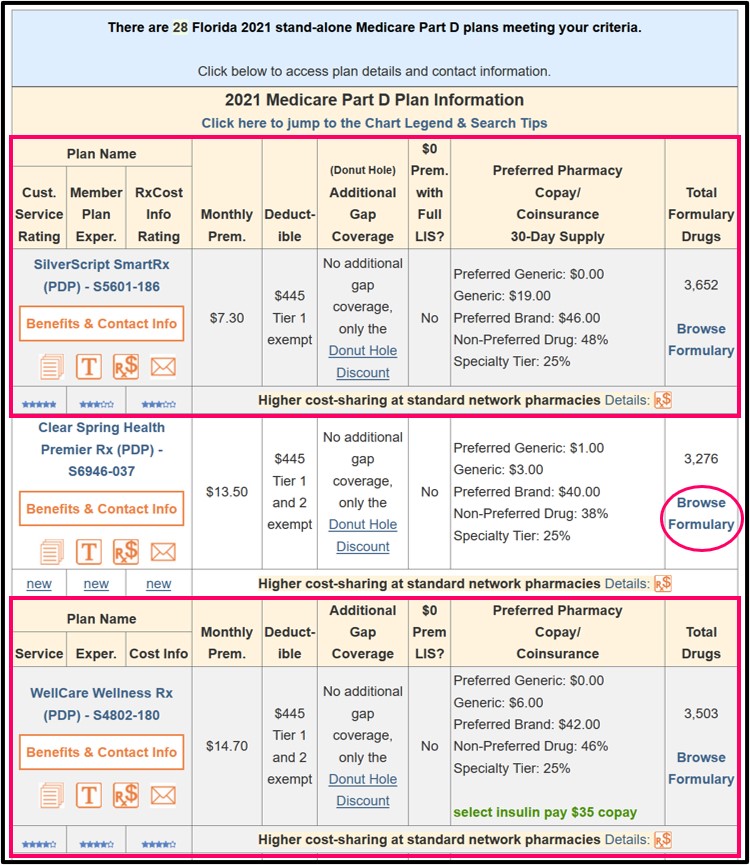

Example: For instance, if you were looking for a Florida stand-alone Medicare Part D plan (you can change the state to whatever you wish), you could view the plans at the following link: PDP-Finder.com/FL.

You will notice in the following graphic that the Medicare Part D plans are sorted with the lowest monthly premium first and below the plan information, you can see text reading: "Higher cost-sharing at standard network pharmacies" (this text will be added as cost-sharing data becomes available).

The cost sharing details shown on our Medicare Part D plan finder are for the plan's "preferred" network pharmacies (for instance, Tier 2 Non-Preferred Generics for $3.00).

The cost sharing details shown on our Medicare Part D plan finder are for the plan's "preferred" network pharmacies (for instance, Tier 2 Non-Preferred Generics for $3.00).

The PDP-Finder Plan Finder shows a link "Benefit & Contact Info" that will show you the different pricing (preferred and non-preferred) for this Medicare Part D plan’s formulary drug tiers.

Preferred v. Standard Pharmacy Network pricing

However, most Medicare prescription drug plans have preferred pharmacy pricing, meaning you will pay less for you formulary medications at a preferred network pharmacy as compared to a non-preferred network pharmacy.

In our Medicare Part D Plan Finder (PDP-Finder.com), we indicate the drug plans that use both preferred pharmacy and the non-preferred network pharmacy pricing with the text, "Non-preferred network pharmacies have higher cost-sharing" shown below the plan details.

Example: For instance, if you were looking for a Florida stand-alone Medicare Part D plan (you can change the state to whatever you wish), you could view the plans at the following link: PDP-Finder.com/FL.

You will notice in the following graphic that the Medicare Part D plans are sorted with the lowest monthly premium first and below the plan information, you can see text reading: "Higher cost-sharing at standard network pharmacies" (this text will be added as cost-sharing data becomes available).

The PDP-Finder Plan Finder shows a link "Benefit & Contact Info" that will show you the different pricing (preferred and non-preferred) for this Medicare Part D plan’s formulary drug tiers.

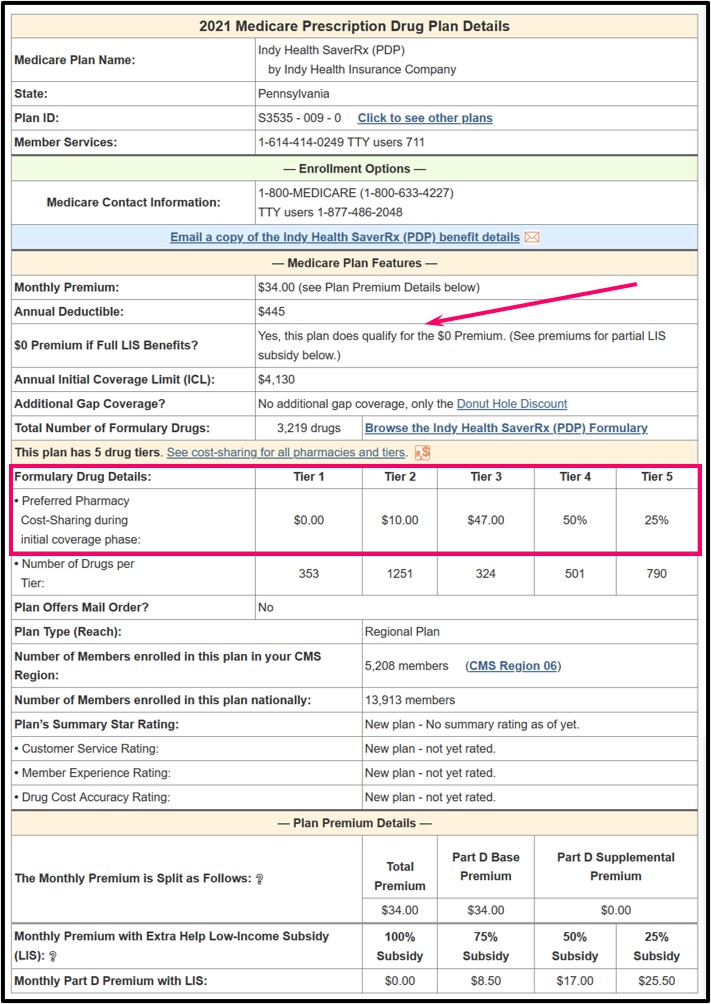

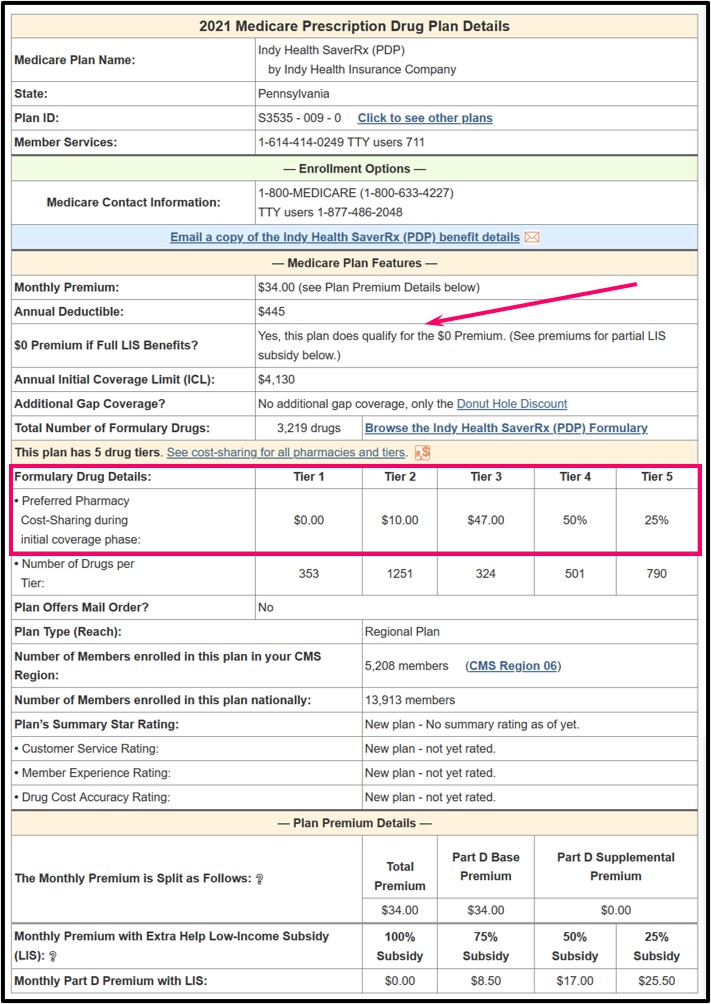

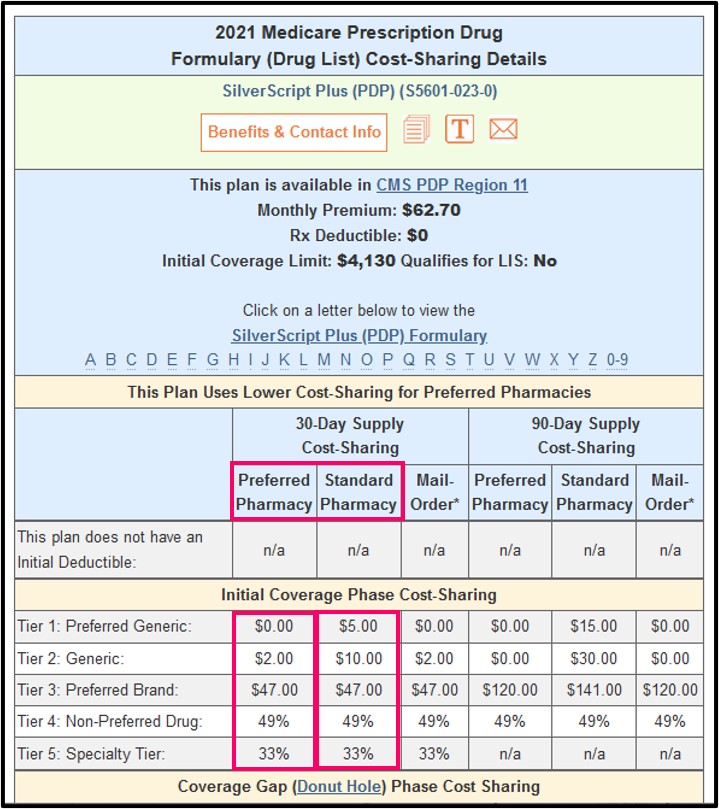

If you click on the "Details" link next to the Rx$ icon, you will be able to see the plan's cost-sharing at preferred and standard pharmacies.

On this page, please notice that Tier 1 Preferred Generics will cost a $0.00 co-payment when purchased at a preferred network pharmacy or a $5.00 co-pay when this same generic is purchased at a standard network pharmacy. Tier 2 Generics will have a co-pay of $2.00 at a preferred network pharmacy and a $10.00 co-pay at a standard network pharmacy.

Note: You will also notice that all formulary tiers have preferred pharmacy pricing when purchased through the plan's mail-order option.

On to the second point: cost-sharing during the deductible period is also a relatively new feature in some Medicare Part D plans.

Usually when a plan has a $445 initial deductible, you will pay the first $445 toward your medications before your plan’s coverage begins. However, many Medicare Part D drug plans now have certain drug tiers (usually low cost Tier 1 and Tier 2 generics) that are exempt from the deductible so you get coverage from the very start as if you had no deductible.

Other than our Medicare Part D Plan Finder (PDP-Finder.com) and Medicare Advantage Plan Finder (MA-Finder.com), our Formulary Browser also shows that a particular drug Tier is exempt from the plan’s initial deductible.

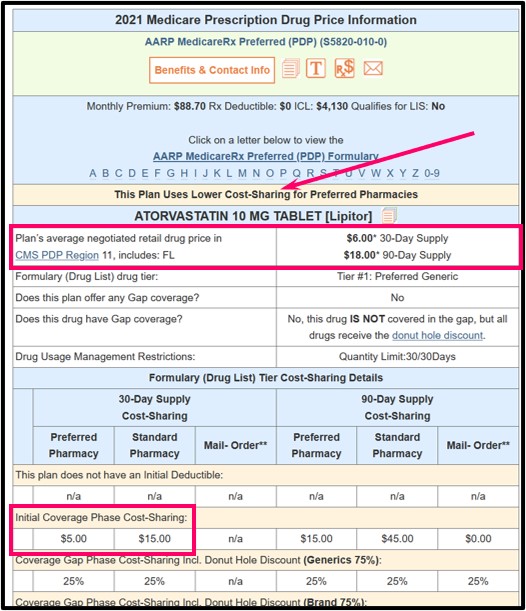

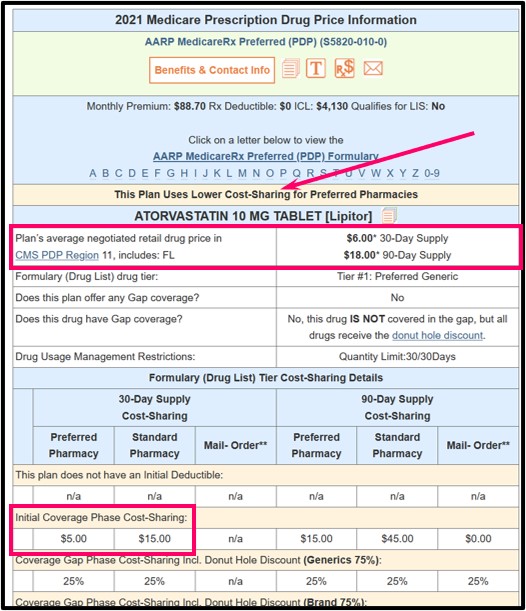

The following graphic shows an example of Atorvastatin 10mg as a Tier 1 Preferred Generic with an average negotiated retail cost of around $6 and a co-payment of $5.00 when purchased at a preferred network pharmacy during the Initial Coverage Phase (there is no deductible). The standard pharmacy co-payment is $15, but you would actually never pay more than retail cost for your drugs, even when the co-payment is higher. So at a standard network pharmacy you would pay around $6 (or the plan's full negotiated retail cost that is under the $15 co-pay).

Bottom Line: Look at the details of your chosen Medicare Part D plans to learn more about pricing at different pharmacies or during the initial deductible.

Bottom Line: Look at the details of your chosen Medicare Part D plans to learn more about pricing at different pharmacies or during the initial deductible.

The following graphic shows an example of Atorvastatin 10mg as a Tier 1 Preferred Generic with an average negotiated retail cost of around $6 and a co-payment of $5.00 when purchased at a preferred network pharmacy during the Initial Coverage Phase (there is no deductible). The standard pharmacy co-payment is $15, but you would actually never pay more than retail cost for your drugs, even when the co-payment is higher. So at a standard network pharmacy you would pay around $6 (or the plan's full negotiated retail cost that is under the $15 co-pay).

News Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service