Q1Group analysis finds Florida seniors will have fewer 2016 stand-alone Medicare Part D plan choices and higher monthly premiums.

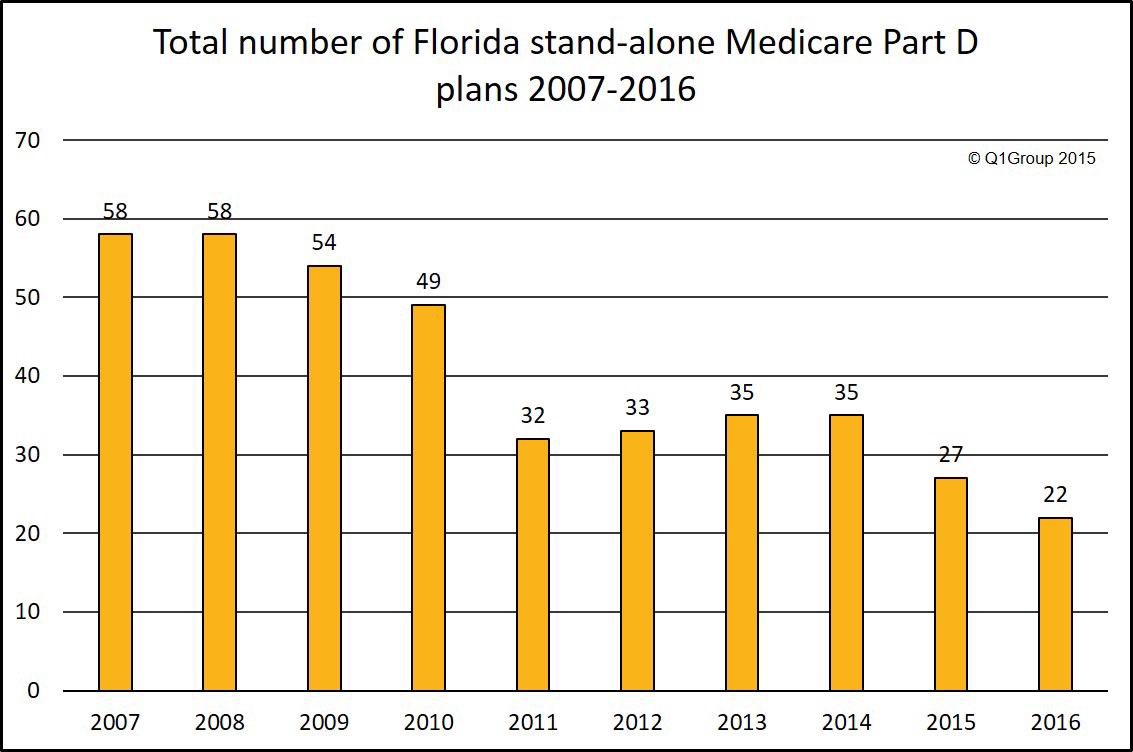

A preliminary analysis of the 2016 Medicare Part D landscape data recently released by the Centers for Medicare and Medicaid Services (CMS) shows that Florida seniors will have fewer stand-alone 2016 Medicare Part D plans (PDP) choices and higher monthly PDP premiums.

The summary of Florida’s 2016 stand-alone Medicare Part D landscape is available at: PDP-Facts.com/FL.

Across the state, Florida Medicare beneficiaries will have the choice of 22 stand-alone 2016 Medicare Part D plans, losing five plans from the 27 stand-alone PDPs available in 2015. Currently, three of these 22 Medicare Part D plans offered in 2016 are under CMS sanctions and not accepting enrollment.

Medicare beneficiaries enrolled in a 2015 Medicare plan not offered in 2016 are encouraged to review their Medicare Part D plan’s Annual Notice of Change (or ANOC) letter to see if they will be automatically moved to another 2016 prescription drug plan or whether they need to actively choose a new 2016 Medicare Part D plan or Medicare Advantage plan.

Florida residents can also use the Q1Medicare PDP-Compare tool to learn more about availability and basic changes in their 2016 stand-alone Medicare Part D plan coverage: PDP-Compare.com/FL.

Low-income Florida Medicare beneficiaries who qualify for the full financial "Extra Help" program, will also find fewer 2016 Part D plans qualifying for the $0 premium Low-Income Subsidy (LIS). In 2016, only three Medicare Part D plans will qualify for the full $0 premium Low-Income Subsidy as compared to the four LIS-qualifying 2015 Part D plans.

Along with the reduction in 2016 stand-alone Part D plan choices, Florida seniors will also find fewer low-premium 2016 plan options. In fact, there is only one 2016 Medicare Part D plan offered with a monthly premium under $25: the 2016 Humana Walmart Rx plan ($18.40), that includes the 2016 standard deductible of $360.

As in 2015, the majority of 2016 stand-alone Medicare Part D plans will include an Initial Deductible ranging from $250 to the standard 2016 deductible of $360. The lowest costing Medicare Part D plan with a $0 deductible will be the 2016 SilverScript Choice (PDP) plan ($25.60).

Unfortunately, of the 22 returning 2015 Medicare Part D plans, only one 2016 Medicare Part D plan will offer a monthly premium that was lowered from 2015. This means that, based on current Medicare Part D plan enrollment, around 99% of Florida Medicare beneficiaries are enrolled in a stand-alone 2015 Medicare Part D plan that will see an increased monthly premium, unless these people choose to enroll in a lower-costing Medicare prescription drug or Medicare Advantage plan.

Finally, slightly fewer 2016 stand-alone Medicare Part D plans also will offer any form coverage for drug purchases made in the 2016 Donut Hole. The good news is that, the 2016 Donut Hole discount will continue to provide a 55% discount on brand-name drugs and increase the generic drugs discount to 42% for all Medicare beneficiaries who exceed the 2016 Initial Coverage Limit of $3,310.

Q1Medicare.com reminds seniors and other Medicare beneficiaries that they can enroll in a 2016 Medicare Part D prescription drug plan or Medicare Advantage plan during the annual Open Enrollment Period starting October 15th and continuing through December 7th.

Starting October 1st, Medicare beneficiaries area also encouraged to contact a Medicare representative at 1-800-633-4227 (1-800-Medicare) for assistance finding a Medicare plan that most economically covers their health and prescription needs.

The summary of Florida’s 2016 stand-alone Medicare Part D landscape is available at: PDP-Facts.com/FL.

Across the state, Florida Medicare beneficiaries will have the choice of 22 stand-alone 2016 Medicare Part D plans, losing five plans from the 27 stand-alone PDPs available in 2015. Currently, three of these 22 Medicare Part D plans offered in 2016 are under CMS sanctions and not accepting enrollment.

Medicare beneficiaries enrolled in a 2015 Medicare plan not offered in 2016 are encouraged to review their Medicare Part D plan’s Annual Notice of Change (or ANOC) letter to see if they will be automatically moved to another 2016 prescription drug plan or whether they need to actively choose a new 2016 Medicare Part D plan or Medicare Advantage plan.

Florida residents can also use the Q1Medicare PDP-Compare tool to learn more about availability and basic changes in their 2016 stand-alone Medicare Part D plan coverage: PDP-Compare.com/FL.

Low-income Florida Medicare beneficiaries who qualify for the full financial "Extra Help" program, will also find fewer 2016 Part D plans qualifying for the $0 premium Low-Income Subsidy (LIS). In 2016, only three Medicare Part D plans will qualify for the full $0 premium Low-Income Subsidy as compared to the four LIS-qualifying 2015 Part D plans.

Along with the reduction in 2016 stand-alone Part D plan choices, Florida seniors will also find fewer low-premium 2016 plan options. In fact, there is only one 2016 Medicare Part D plan offered with a monthly premium under $25: the 2016 Humana Walmart Rx plan ($18.40), that includes the 2016 standard deductible of $360.

As in 2015, the majority of 2016 stand-alone Medicare Part D plans will include an Initial Deductible ranging from $250 to the standard 2016 deductible of $360. The lowest costing Medicare Part D plan with a $0 deductible will be the 2016 SilverScript Choice (PDP) plan ($25.60).

Unfortunately, of the 22 returning 2015 Medicare Part D plans, only one 2016 Medicare Part D plan will offer a monthly premium that was lowered from 2015. This means that, based on current Medicare Part D plan enrollment, around 99% of Florida Medicare beneficiaries are enrolled in a stand-alone 2015 Medicare Part D plan that will see an increased monthly premium, unless these people choose to enroll in a lower-costing Medicare prescription drug or Medicare Advantage plan.

Finally, slightly fewer 2016 stand-alone Medicare Part D plans also will offer any form coverage for drug purchases made in the 2016 Donut Hole. The good news is that, the 2016 Donut Hole discount will continue to provide a 55% discount on brand-name drugs and increase the generic drugs discount to 42% for all Medicare beneficiaries who exceed the 2016 Initial Coverage Limit of $3,310.

Q1Medicare.com reminds seniors and other Medicare beneficiaries that they can enroll in a 2016 Medicare Part D prescription drug plan or Medicare Advantage plan during the annual Open Enrollment Period starting October 15th and continuing through December 7th.

Starting October 1st, Medicare beneficiaries area also encouraged to contact a Medicare representative at 1-800-633-4227 (1-800-Medicare) for assistance finding a Medicare plan that most economically covers their health and prescription needs.

News Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service