Q1Group 2016 PDP Analysis: Fewer stand-alone 2016 Medicare Part D prescription drug plan choices

According to the recently released Centers for Medicare and Medicaid Services (CMS) Medicare Part D landscape data, most Medicare beneficiaries will have slightly fewer stand-alone 2016 Medicare Part D prescription drug plan choices.

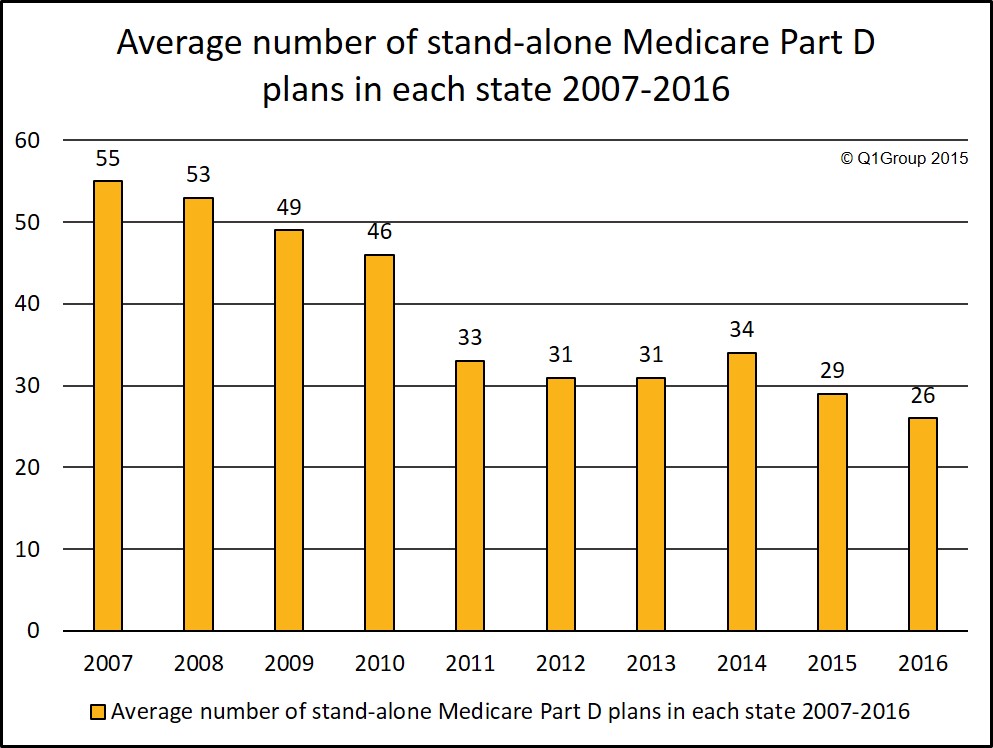

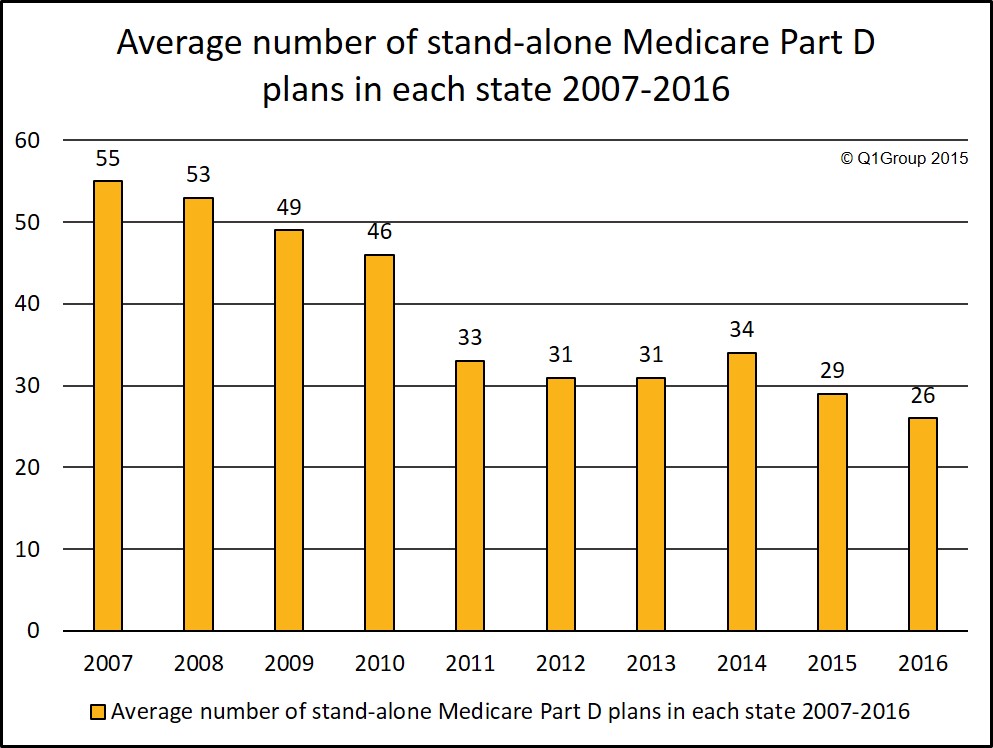

As was true last year, on average, there will be fewer 2016 stand-alone Medicare Part D prescription drug plan (PDP) choices. In 2016, the average number of stand-alone Medicare Part D plans offered in each state dropped to an average of 26 stand-alone PDPs from an average of 29 stand-alone Part D plans available in 2015.

In comparison to past years, there were an average of 34 stand-alone 2014 Medicare Part D plans (not including Medicare Advantage plans), 31 stand-alone 2013 Medicare Part D plans, and, back in 2009 - an average of 49 stand-alone Medicare Part D plans offered in each CMS PDP region (see chart below).

The Highs

Pennsylvania and West Virginia will have the largest selection of 2016 stand-alone Medicare Part D plans (again offering Medicare beneficiaries 29 PDPs).

The Lows

As was true in 2015, Alaska Medicare beneficiaries will again have the smallest selection of 2016 stand-alone Medicare Part D plans (19 PDPs - down from 24 PDPs in 2015).

Largest Changes

Alaska, Illinois, and Florida will see the largest decrease of stand-alone Medicare Part D plans in 2016 with each state losing 5 PDP choices. In 2015, Illinois was the state having the largest selection of stand-alone Medicare Part D plans (33 PDP plans).

A detailed overview of the 2016 Medicare Part D landscape data can be found in the Q1Medicare.com PDP-Facts section with Part D plan summaries on a national and state level.

Please note that we will continue to update the Medicare Part D plan coverage details throughout the year as more information becomes available.

Reminder: No need to rush.

Medicare Part D plan carriers can start marketing their plans on October 1st and the annual Medicare Open Enrollment Period for 2016 Medicare Part D plans and Medicare Advantage plans begins on Thursday, October 15th and continues through Monday, December 7th, with 2016 Medicare plan coverage beginning on Friday, January 1, 2016.

For more information, starting October 1st, Medicare beneficiaries can telephone Medicare at 1-800-633-4227, speak with a Medicare representative, and learn more about their 2016 Medicare Part D and Medicare Advantage plan options.

Please note: The 2016 Medicare Advantage plan landscape summary will be presented separately in another article. The above information is from our Medicare Part D plan landscape summaries and based only on stand-alone Medicare Part D prescription drug plans (or PDPs).

A number of the 2016 Medicare Advantage plans may be available in your area and may include comprehensive prescription drug coverage, along with Medicare Part A (hospitalization), Medicare Part B (out-patient and physician), and additional healthcare benefits (these Medicare plans are also called MAPD plans).

Not sure where to begin with all this information or you have a question for us? No problem, click here to let us know.

As was true last year, on average, there will be fewer 2016 stand-alone Medicare Part D prescription drug plan (PDP) choices. In 2016, the average number of stand-alone Medicare Part D plans offered in each state dropped to an average of 26 stand-alone PDPs from an average of 29 stand-alone Part D plans available in 2015.

In comparison to past years, there were an average of 34 stand-alone 2014 Medicare Part D plans (not including Medicare Advantage plans), 31 stand-alone 2013 Medicare Part D plans, and, back in 2009 - an average of 49 stand-alone Medicare Part D plans offered in each CMS PDP region (see chart below).

The Highs

Pennsylvania and West Virginia will have the largest selection of 2016 stand-alone Medicare Part D plans (again offering Medicare beneficiaries 29 PDPs).

The Lows

As was true in 2015, Alaska Medicare beneficiaries will again have the smallest selection of 2016 stand-alone Medicare Part D plans (19 PDPs - down from 24 PDPs in 2015).

Largest Changes

Alaska, Illinois, and Florida will see the largest decrease of stand-alone Medicare Part D plans in 2016 with each state losing 5 PDP choices. In 2015, Illinois was the state having the largest selection of stand-alone Medicare Part D plans (33 PDP plans).

A detailed overview of the 2016 Medicare Part D landscape data can be found in the Q1Medicare.com PDP-Facts section with Part D plan summaries on a national and state level.

Please note that we will continue to update the Medicare Part D plan coverage details throughout the year as more information becomes available.

Reminder: No need to rush.

Medicare Part D plan carriers can start marketing their plans on October 1st and the annual Medicare Open Enrollment Period for 2016 Medicare Part D plans and Medicare Advantage plans begins on Thursday, October 15th and continues through Monday, December 7th, with 2016 Medicare plan coverage beginning on Friday, January 1, 2016.

For more information, starting October 1st, Medicare beneficiaries can telephone Medicare at 1-800-633-4227, speak with a Medicare representative, and learn more about their 2016 Medicare Part D and Medicare Advantage plan options.

Please note: The 2016 Medicare Advantage plan landscape summary will be presented separately in another article. The above information is from our Medicare Part D plan landscape summaries and based only on stand-alone Medicare Part D prescription drug plans (or PDPs).

A number of the 2016 Medicare Advantage plans may be available in your area and may include comprehensive prescription drug coverage, along with Medicare Part A (hospitalization), Medicare Part B (out-patient and physician), and additional healthcare benefits (these Medicare plans are also called MAPD plans).

Not sure where to begin with all this information or you have a question for us? No problem, click here to let us know.

News Categories

Pets are Family Too!

Use your drug discount card to save on medications for the entire family ‐ including your pets.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service