2015 CMS Press release: "[2016] Medicare prescription drug premiums projected to remain stable"

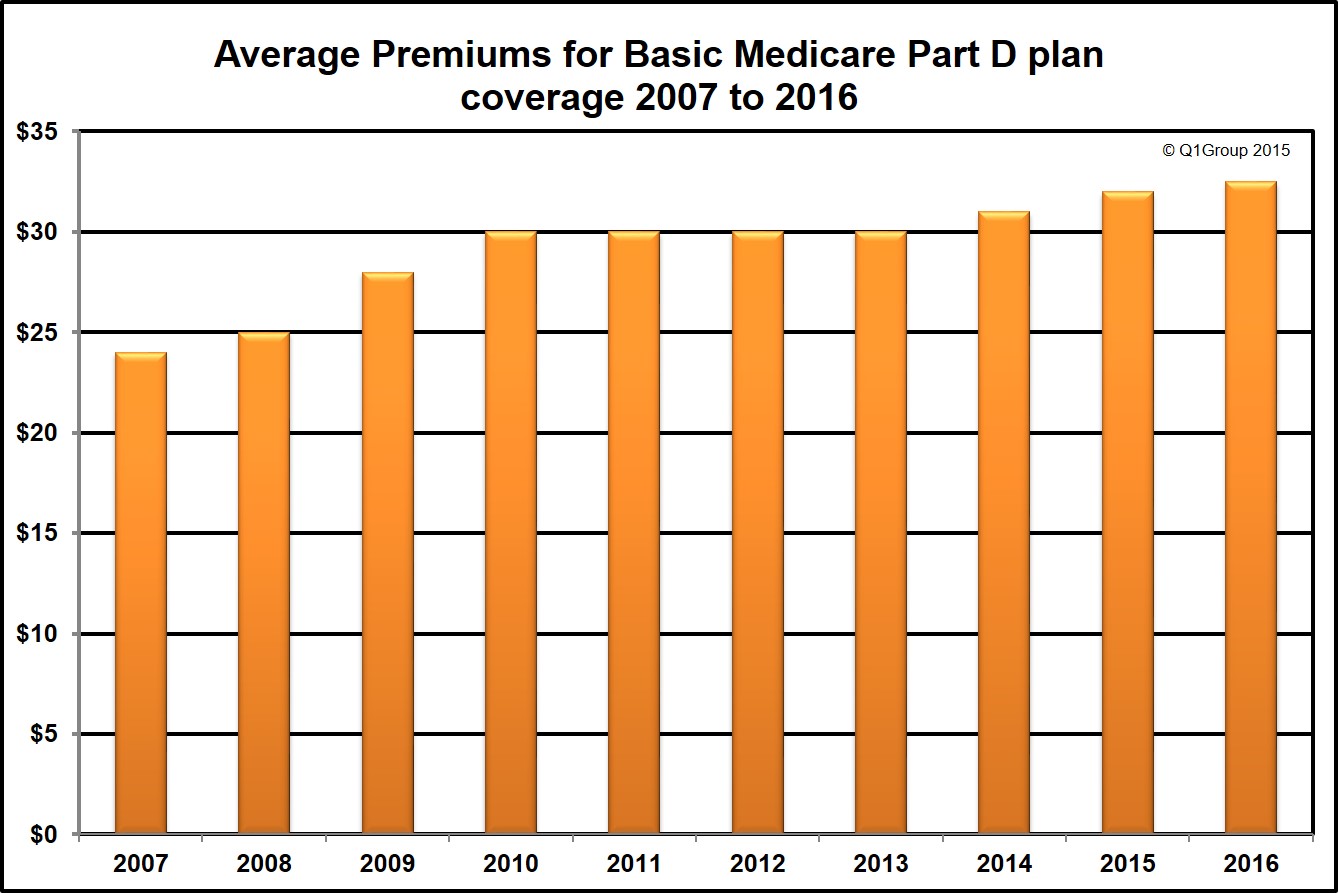

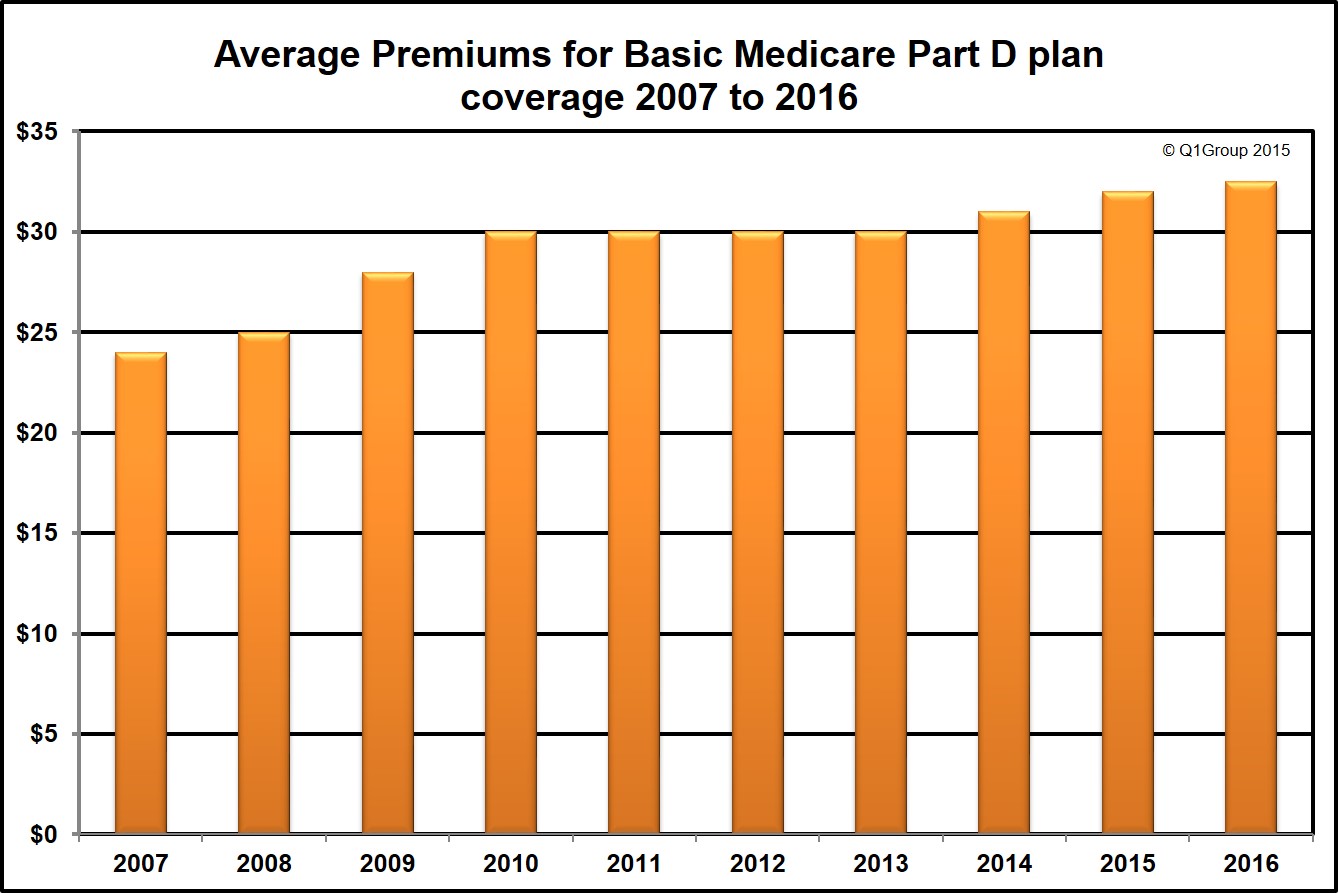

The Centers for Medicare and Medicaid Services (CMS) announced today that average monthly Medicare Part D premiums should remain stable in 2016. Based on the Medicare Part D plan carrier bids, the average base monthly premium for 2016 should be around $32.50, up just slightly over the $32 base premium in 2015, and the $31 premium estimate in 2014.

Please note: Medicare beneficiaries are reminded that the average monthly Medicare Part D premium figure released today may not represent the actual changes in their Medicare Part D prescription drug plan premiums - and they should be prepared to research other, more economic forms of health and prescription coverage during the annual Open Enrollment Period that begins October 15, 2015.

As reference, here are the weighted average monthly premiums for a standard or basic Medicare Part D prescription drug plan reported by HHS or CMS since 2007. (We do not have a reported figure from 2005 reporting on the beginning of the Medicare Part D program in 2006).

Please note: In comparison to the past average basic Medicare Part D premium reported by CMS or HHS (Medicare), we usually report a higher average premium since we are only considering stand-alone Medicare Part D prescription drug plans (PDPs) and not Medicare Advantage plans that also include prescription drug coverage (MAPDs) because many of these MAPDs have a low or $0 premium and this skews the average monthly premium for prescription drug coverage toward lower values:

Please note: Medicare beneficiaries are reminded that the average monthly Medicare Part D premium figure released today may not represent the actual changes in their Medicare Part D prescription drug plan premiums - and they should be prepared to research other, more economic forms of health and prescription coverage during the annual Open Enrollment Period that begins October 15, 2015.

As reference, here are the weighted average monthly premiums for a standard or basic Medicare Part D prescription drug plan reported by HHS or CMS since 2007. (We do not have a reported figure from 2005 reporting on the beginning of the Medicare Part D program in 2006).

Please note: In comparison to the past average basic Medicare Part D premium reported by CMS or HHS (Medicare), we usually report a higher average premium since we are only considering stand-alone Medicare Part D prescription drug plans (PDPs) and not Medicare Advantage plans that also include prescription drug coverage (MAPDs) because many of these MAPDs have a low or $0 premium and this skews the average monthly premium for prescription drug coverage toward lower values:

- We calculated the 2015 average monthly premium across all stand-alone Medicare Part D plans (not considering Medicare Advantage plans offering prescription drug coverage or MAPDs) to be $53.14 or $36.75 when weighted by stand-alone Medicare Part D plan enrollment.

- We calculated the 2014 average monthly premium across all stand-alone Medicare Part D plans (not considering Medicare Advantage plans offering prescription drug coverage or MAPDs) to be $53.80 or $41.23 when weighted by stand-alone Medicare Part D plan enrollment.

- We calculated the 2013 average monthly premium across all stand-alone Medicare Part D plans to be $53.26 or $40.63 when weighted by all stand-alone Medicare Part D plan enrollment.

- We calculated the 2012 average premium across all stand-alone Medicare Part D plans to be $53.99 or $39.62 when weighted by plan enrollment.

- In 2011, we calculated the average monthly premium across all stand-alone Medicare Part D plans as $53.77 -- or $41.05 when weighted by Medicare Part D plan enrollment.

The text of the July 29, 2015, CMS Press Release is included below:

Medicare prescription drug premiums projected to remain stable

On the eve of the 50th anniversary of the signing of Medicare and Medicaid into law, the Centers for Medicare & Medicaid Services (CMS) projected today that the average premium for a basic Medicare Part D prescription drug plan in 2016 will remain stable, at an estimated $32.50 per month.

“Seniors and people with disabilities are continuing to benefit from stable prescription drug premiums and a competitive and transparent marketplace for Medicare drug plans,” said acting CMS Administrator Andy Slavitt. “While this is good news, we must ensure that Medicare Part D remains affordable for Medicare beneficiaries so that they can have access to the prescription drugs that they need.”

This news comes despite the fact that total Part D costs per capita grew by almost 11 percent in 2014, driven largely by high cost specialty drugs and their effect on spending in the catastrophic benefit phase. As the Medicare Payment Advisory Commission (MedPAC) recently reported, total Medicare payments to plans for reinsurance have grown by more than three times the pace of premium growth.

However, growth in per-Medicare enrollee spending continues to be historically low, averaging 1.3 percent over the last five years. The recent 2015 Medicare Trustees report projected that the Medicare Trust Fund will remain solvent until 2030, thirteen years longer than they projected in 2009, prior to passage of the Affordable Care Act (ACA).

Seniors and people with disabilities are continuing to see savings on out of pocket drug costs as the ACA closes the Part D donut hole over time. Since the enactment of the ACA, more than 9.4 million seniors and people with disabilities have saved over $15 billion on prescription drugs, an average of $1,598 per beneficiary.

For the past five years – for plan years 2011-2015 – the average Medicare Part D monthly premium for a basic plan has been between $30 and $32. Today’s projection for the average premium for 2016 is based on bids submitted by drug and health plans for basic drug coverage for the 2016 benefit year and calculated by the independent CMS Office of the Actuary.

The upcoming annual open enrollment period – which begins October 15 and ends December 7 – allows people with Medicare to choose health and drug plans next year by comparing their current coverage and plan quality ratings to other plan offerings. New benefit choices are effective January 1, 2016.

To view the Part D Base Beneficiary Premium, the Part D National Average Monthly Bid Amount, the Part D Regional Low-Income Premium Subsidy Amounts, the De Minimis Amount, the Part D income-related monthly adjustment amounts, and the Medicare Advantage Regional Benchmarks, go to: www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Ratebooks-and-Supporting-Data.html and select “2016.”

To learn more about the Medicare Part D prescription drug benefit, go to: www.medicare.gov/part-d/.

# # #

[Emphasis and Highlighting added]

- 2024 PY CMS Press Release: Q1News.com/1007

- 2023 PY CMS Press Release: Q1News.com/981

- 2022 PY CMS Press Release: Q1News.com/887

- 2021 PY CMS Press Release: Q1News.com/833

- 2020 PY CMS Press Release: Q1News.com/780

- 2019 PY CMS Press Release: Q1News.com/718

- 2018 PY CMS Press Release: Q1News.com/639

- 2017 PY CMS Press Release: Q1News.com/581

- 2016 PY CMS Press Release: Q1News.com/481

- 2015 PY CMS Press Release: Q1News.com/360

- 2014 PY CMS Press Release: Q1News.com/300

- 2013 PY CMS Press Release: Q1News.com/224

- 2012 PY CMS Press Release: Q1News.com/163

- 2011 PY CMS Press Release: Q1News.com/149

- 2010 PY CMS Press Release: Q1News.com/131

- 2009 PY CMS Press Release: Q1News.com/93

- 2008 PY CMS Press Release: Q1News.com/34

- 2007 PY CMS Press Release: Q1News.com/164

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service