Medicare Part D prescription drug plan & Medicare Advantage plan information

2024

Medicare Part D plans

(prescription only coverage)

Click your state to compare all Medicare Part D prescription drug plans (PDPs)

Medicare Part D prescription drug plans (PDPs) provide insurance coverage for your prescription drugs. Medicare Advantage plans (MAs or MAPDs) provide your Medicare Part A coverage (In-patient and Hospitalization) and your Medicare Part B coverage (Doctors visits and Out-Patient care) - and maybe even Medicare prescription drug coverage.

Medicare Part D plans and Medicare Advantage plans are both voluntary programs and you are not required to join a plan. But you may be subject to a late-enrollment penalty if you decide to join a prescription drug plan sometime after your initial enrollment period has ended.

Medicare Part D plans and Medicare Advantage plans are regulated by the Centers for Medicare and Medicaid Services (CMS or Medicare) and implemented by private insurance companies (such as Aetna, Humana, and United HealthCare).

If you decide to enroll in a Medicare Part D plan or Medicare Advantage plan, you will find that, like any insurance, you pay a monthly premium. The monthly premiums for a Medicare Part D PDP can range from under $10 to over $156. The monthly premiums for a Medicare Advantage plan with (MAPD) or without (MA) prescription coverage can range from $0 (or less) to $313.

Medicare Part D and Medicare Advantage plans may have an initial deductible, copayments or coinsurance, and some Donut Hole (Doughnut Hole) or Gap coverage (you can find more on these topics in our Glossary).

When you enroll in a Medicare Part D prescription drug plan or a Medicare Advantage plan that offers prescription coverage, you should find that your prescription medication costs are reduced. The amount of savings depends on the Medicare plan you select. Click on this link to view all of the Medicare Part D plans in your State.

Medicare suggests that you look at Coverage, Cost, and Convenience - and to these criteria we also suggest you consider the Company and your level of Comfort.

- Coverage - Are your prescription medications covered by this plan? Are there generic alternatives for your brand-name drugs? Can you work with this plan to get a

formulary exception should you need a medication that is

not covered on the existing formulary? What cost-sharing applies to your medications? What health coverage does the Medicare Advantage plan offer beyond basic Medicare?

Are there any additional benefits offered by the plan?

- Cost - What are the monthly plan premiums? Does the Medicare Part D plan or Medicare Advantage plan have an

initial deductible?

What are the copayments or coinsurance that you pay for your medications or healthcare? What are the plan's

coverage limits?

Is there any prescription coverage in the Donut Hole in addition to the

donut hole discount?

Also see: But isn’t the

Coverage Gap (Donut Hole) closed?

- Convenience - How difficult is it to find a pharmacy or a health care provider? (Note: most national Medicare Part D plans have a

pharmacy network of over 50,000 pharmacies.) Are you restricted to a single healthcare network? Do your doctors accept this Medicare Advantage plan?

How easy is it to work with this Medicare Part D plan or Medicare Advantage plan?

- Company - Are you familiar with the company or organization who provides the Medicare Part D or Medicare Advantage plan?

Often people choose a Medicare plan based only the Medicare plan provider's reputation, recommendation, or

Medicare star ratings.

- Comfort - Are you comfortable with your current Medicare Part D plan or Medicare Advantage plan? Would you rather spend a few extra dollars per month because you know how your current Medicare plan operates and your plan costs are predictable?

You can enroll in a stand-alone Medicare Part D Prescription Drug plan or a Medicare Advantage plan during the Annual Open Enrollment Period (AEP) starting October 15th and continuing for seven weeks through December 7th. Your newly selected Medicare plan coverage starts on January 1st of the following year.

You also may be eligible for a Special Enrollment Period (SEP) allowing you to change Medicare plans outside of the AEP.

The Medicare Advantage Open Enrollment Period (MA OEP) for Medicare Advantage plans begins January 1st and continues through March 31st -- during the MA OEP current members of Medicare Advantage plans can switch their Medicare Advantage plan or go back to Original Medicare and join a stand-alone Medicare Part D drug plan.

If you are just turning 65 or newly eligible for Medicare, you will be granted a seven (7) month Initial Enrollment Period (IEP) during which you can join a Medicare Part D or Medicare Advantage plan. The seven month period begins three months before your Medicare eligibility (or birthday) month, includes your eligibility month, and continues for three months after your Medicare eligibility month. However, your Medicare plan can begin no sooner than the first day of your Medicare eligibility month.

You always pay the same amount for a Medicare Part D plan or Medicare Advantage plan, no matter where or how you enroll.

You can enroll directly with Medicare (1-800-Medicare) or with an insurance agent or the Medicare plan provider. No matter how you enroll in to a Medicare plan, the enrollment result should always be the same and in 10 business days you should receive your Medicare Part D new member information.

Once enrolled into a Medicare Part D or Medicare Advantage plan, you can contact the plan's Member Services department with any questions or concerns. The toll-free number will be on the back of your Member ID card.

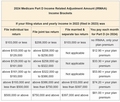

Medicare Part D beneficiaries with annual income (MAGI) over $103,000 (individual) or over $206,000 for couples filing joint (see 2024 IRMAA rate charts) will pay the Medicare Part D Income-Related Monthly Adjustment Amount (IRMAA) in addition to their monthly Medicare Part D plan premium.

Would you like to learn more about 2024 Medicare Part D Prescription Drug Plans?

We have information available for all 2024 Medicare Part D prescription drug plans across the country. We provide a national overview of all Part D plans and state specific summaries of the Medicare Part D prescription drug plans in your area. Here are a few state examples:

The Part D plan summaries are interactive so you can click on any "linked" or underlined numbers and get a better idea of the actual Part D plan details and Part D plan changes.

-

Your (1) Member ID number, (2) Rx BIN, (3) PCN, and (4) Group ID (or Rx Group) number are the four numbers that uniquely identify you and your Medicare Part D prescription drug plan - and these four n . . .

-

You will receive a 75% discount on all formulary drugs if you reach the Donut Hole or Coverage Gap. Changes coming to the Medicare Part D Donut Hole. Spoiler Alert: In 2025, the Inflation Re . . .

-

Medicare Part D prescription drug plans provide insurance coverage for your out-patient prescription drugs - and works just like any other type of insurance: (1) Monthly premium. You us . . .

-

No. Medicare Advantage plans are not the same as Medicare Supplements or Medigap policies. And here are a few key differences between the plans: Medigap policy design Medica . . .

-

You can drop, disenroll, or cancel your Medicare Part D plan or Medicare Advantage plan coverage during the annual Open Enrollment Period - or a Special Enrollment Period - or you can be involuntarily disenrolled from your plan.

2024

Medicare Advantage plans

(MA, MAPD, SNP, MMP)

Enter your zip code to compare all Medicare Advantage plans

Or click on your state below:

AK

AL

AR

AS

AZ

CA

CO

CT

DC

DE

FL

GA

GU

HI

IA

ID

IL

IN

IS

KS

KY

LA

MA

MD

ME

MI

MN

MO

MS

MT

NC

ND

NE

NH

NJ

NM

NV

NY

OH

OK

OR

PA

PR

RI

SC

SD

TN

TX

UT

VA

VI

VT

WA

WI

WV

WY

Q1Rx is designed for fast, medication searches and provides plan details, cost-sharing, and average retail drug price, and drug usage management information for your covered medication.

With Q1Rx, you can search for a medication different ways and find the coverage details for all Medicare Part D plans in your state.

- See if a particular drug is covered by ANY Medicare Part D plan in your state.

Click here for an example of plans covering 10MG Atorvastatin [generic Lipitor] in Texas.

- See if a drug is covered by your particular Medicare Advantage plan’s drug formulary.

Click here for an example of AARP Medicare Advantage plans covering 40MG ESOMEPRAZOLE [generic Nexium] in Summit County, Ohio.

- Compare drug costs & coverage between two different carriers.

Click here for an example of how Humana and AARP plans compare for 100MG Quetiapine Fumarate [generic Seroquel] in California.

- Not sure how to spell the name of your drug?

Just type in the first three letters and choose from the list of possibilities.

- Do you know the NDC (11-digit National Drug Code) for your medication?

Just type it in, select your state and click on "Search".

- Is this all a bit too complicated? No problem, we have a basic drug search tool that you can use. Click here for our Basic Drug Search example of all PDP plans covering 10MG AMLODIPINE BESYLATE [generic Norvasc] in Pennsylvania.

-

Jan, 27 2024 — If you are eligible for Medicare and having difficulties paying for your prescription drugs, you may want to learn more about the Medicare Part D Extra-Help program by calling or visiting a local stat . . .

-

Jan, 13 2024 — The 2024 Federal Poverty Level (FPL) Guidelines determine the income level requirements for people applying for the Medicare Part D Low-Income Subsidy (LIS) program, also known as the "Extra Help" program that helps pay Medicare prescription drug costs.

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 1 of 6 (E3 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 2 of 6 (H2 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 3 of 6 (H3 . . .

Want to learn a little bit more about MAs?

- Click here to go to our MA-Finder, the 2024 Medicare Advantage Plan search tool.

- Browse through States and counties to find Medicare Advantage plans available in your area.

- Click here for a short overview of Medicare Advantage plans.

- Click here for a few frequently asked Medicare Advantage questions (MA-FAQs).

Join the thousands of people who receive our Medicare Part D Newsletter.

Our free Newsletter is published on a regular basis and provides details on various areas of your prescription drug plan coverage. New Medicare developments, frequently asked questions, and even more complex areas of Part D coverage are included. We also welcome reader input and suggestions for new topics. Sign up below. Please note, that we never share your personal information with other parties.

If you receive Extra-Help (also known as LIS) or are dual eligible for Medicare and Medicaid, there are Medicare Prescription Drug plans in your state that will qualify for the $0 monthly premium. Click below to review our state benchmark premium article. You can click on the benchmark premium for your state to review all plans qualifying for the $0 monthly premium.

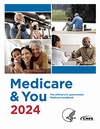

Available for download as PDF (in English & Spanish plus archive). For a printed version of this 128 page document, please telephone Medicare at (1-800-Medicare).

The Centers for Medicare and Medicaid Services (CMS) publishes basic Medicare Part D benefit parameters that are used as a standard for the design of Medicare Part D plans offered by Medicare Part D plan providers.

The 2024 CMS standard Medicare Part D plan provides:

- 2024 standard Initial Deductible: The maximum initial

deductible is $545 (up from $505 in 2023).

- 2024 Initial Coverage Limit (ICL): The 2024 ICL is $5,030,

up from $4,660 in 2023.

- The 2024 Coverage Gap (also known as the Donut Hole): After you

meet your ICL and until your Total Out-of-Pocket (TrOOP) costs

(not including plan premiums) reaches $8,000, you pay 25% of your

plan’s negotiated retail price for formulary prescriptions.

This is known as the donut hole discount.

Also see: But isn’t the Coverage Gap (Donut Hole)

closed?

- Catastrophic Coverage: If your TrOOP (total drug spending) reaches $8,000, you will have 100% coverage ($0 copay) for the remainder of the year.

You can begin to prepare for your 2024 Medicare Part D prescription drug spending now. Millions of Medicare Part D beneficiaries enter the Donut Hole or Coverage Gap each year -- and most people do not exit the Donut Hole, but instead stay in the Donut Hole through the remainder of the year. Would you like to estimate your budget for prescription drug in 2024? Use our free PDP-Planner to plan now for 2024 or review 2023.

You can also use calculators from prior plan years to compare your previous experiences. 2022 • 2021 • 2020

Pets are Family Too!

Use your drug discount card to save on medications for the entire family ‐ including your pets.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service