Q1Medicare.com - Latest Medicare News

Latest News

-

Apr, 29 2024 — The April 2024 Medicare Part D plan drug list updates include ten (10) newly-introduced generics and eight (8) newly-introduced brand-name drugs. There are a total of 67 new ndcs representing 47 different drugs.

-

Apr, 29 2024 — The April 2024 Medicare Part D formulary updates included 67 new drug codes or NDCs representing 47 different medications. The NDC uniquely identifies a particular manufacturer, drug-strength, a . . .

-

Apr, 28 2024 — In some cases you can change Medicare plans outside of the annual Open Enrollment Period (AEP) and the Medicare Advantage OEP (MAOEP) if you can find a Special Enrollment Period.

-

Jan, 27 2024 — If you are eligible for Medicare and having difficulties paying for your prescription drugs, you may want to learn more about the Medicare Part D Extra-Help program by calling or visiting a local stat . . .

-

Jan, 13 2024 — The 2024 Federal Poverty Level (FPL) Guidelines determine the income level requirements for people applying for the Medicare Part D Low-Income Subsidy (LIS) program, also known as the "Extra Help" program that helps pay Medicare prescription drug costs.

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 1 of 6 (E3 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 2 of 6 (H2 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 3 of 6 (H3 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 4 of 6 (H5 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 5 of 6 (H6 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 6 of 6 (H9 . . .

-

Jan, 05 2024 — A number of provision included in the “Inflation Reduction Act” (IRA) will continue to positively impact 2024 Medicare Part D prescription drug plan coverage including: No cost f . . .

-

Dec, 14 2023 — The Centers for Medicare and Medicaid Services (CMS) released the 2024 Rate Announcement with the finalized 2024 defined standard benefits for Medicare Part D plans along with highlights of cost-saving measures especially for Medicare beneficiaries with high prescription costs.

Dec, 14 2023 — The Centers for Medicare and Medicaid Services (CMS) released the 2024 Rate Announcement with the finalized 2024 defined standard benefits for Medicare Part D plans along with highlights of cost-saving measures especially for Medicare beneficiaries with high prescription costs. -

Nov, 27 2023 — The 2024 annual Medicare Open Enrollment Period (AEP) ends December 7th. After December 7th, most people will only have a limited opportunity to change their 2024 Medicare prescription drug plan coverage before next year’s 2025 AEP.

Nov, 27 2023 — The 2024 annual Medicare Open Enrollment Period (AEP) ends December 7th. After December 7th, most people will only have a limited opportunity to change their 2024 Medicare prescription drug plan coverage before next year’s 2025 AEP. -

Nov, 07 2023 — (1) Question: How do I change my Medicare Part D or Medicare Advantage plan? You simply enroll in your selected 2024 Medicare plan. Your current 2023 Medicare plan will be automaticall . . .

Most Viewed News

-

Aug, 16 2023 — A number of changes are included in the Inflation Reduction Act of 2022 impacting future Medicare Part D prescription drug plan coverage.

-

Jan, 14 2023 — The 2023 Federal Poverty Level (FPL) Guidelines determine the income level requirements for people applying for the Medicare Part D Low-Income Subsidy (LIS) program, also known as the "Extra Help" program that helps pay Medicare prescription drug costs

-

Jul, 29 2022 — CMS released the 2023 low-income subsidy (LIS) Benchmark premiums for Medicare Part D plans on July 29, 2022. In 2023, seven regions will lower their LIS benchmark premium, one will remain the same, and 26 regions will increase their benchmark premium.

-

Sep, 28 2022 — Most people will see a slight decrease in their 2023 IRMAA payments. However, due to the annual inflation adjustments, people with MAGI at the bottom of a bracket last year will now be at the to . . .

Sep, 28 2022 — Most people will see a slight decrease in their 2023 IRMAA payments. However, due to the annual inflation adjustments, people with MAGI at the bottom of a bracket last year will now be at the to . . . -

Apr, 04 2022 — On April 4, 2022, the Centers for Medicare and Medicaid Services (CMS) released the 2023 Rate Announcement with the 2023 defined standard benefits for Medicare Part D providing an insight into next year's basic Medicare prescription drug plan coverage.

Apr, 04 2022 — On April 4, 2022, the Centers for Medicare and Medicaid Services (CMS) released the 2023 Rate Announcement with the 2023 defined standard benefits for Medicare Part D providing an insight into next year's basic Medicare prescription drug plan coverage. -

Jan, 27 2024 — If you are eligible for Medicare and having difficulties paying for your prescription drugs, you may want to learn more about the Medicare Part D Extra-Help program by calling or visiting a local stat . . .

-

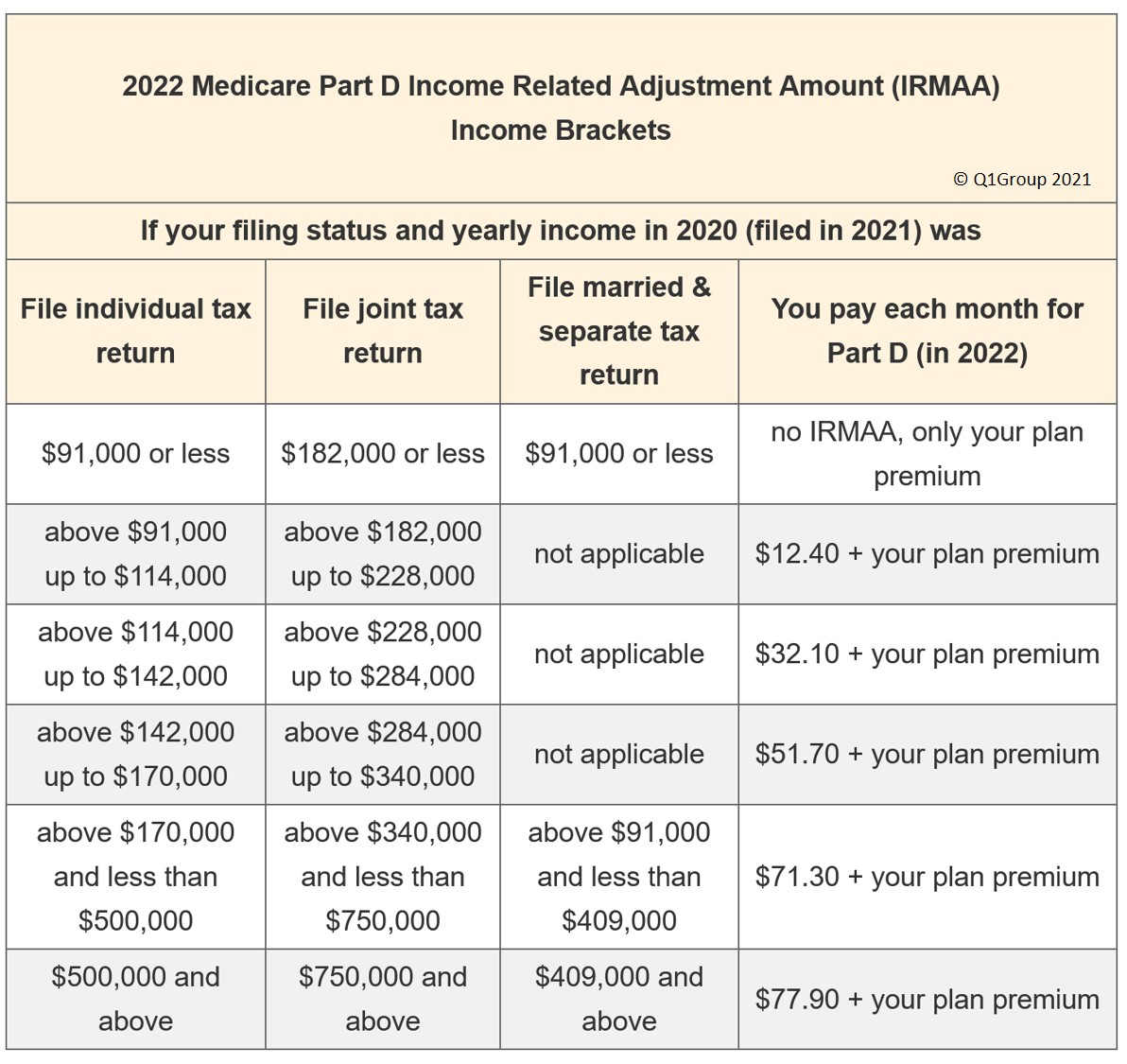

Nov, 13 2021 — Since 2020, the Income-Related Monthly Adjustment

Amount (IRMAA) income brackets are inflation adjusted. Consequently, people with an annual income under $170,000 who are at the low end of thei . . .

Nov, 13 2021 — Since 2020, the Income-Related Monthly Adjustment

Amount (IRMAA) income brackets are inflation adjusted. Consequently, people with an annual income under $170,000 who are at the low end of thei . . . -

Jul, 29 2021 — CMS released the 2022 low-income premium subsidy amounts (or Benchmark premiums) for Medicare Part D plans on July 29, 2021. In 2022, two regions will lower their Medicare Part D Low-Income Subsidy (LIS) benchmark premiums and 32 regions will increase their benchmark premium.

Jul, 29 2021 — CMS released the 2022 low-income premium subsidy amounts (or Benchmark premiums) for Medicare Part D plans on July 29, 2021. In 2022, two regions will lower their Medicare Part D Low-Income Subsidy (LIS) benchmark premiums and 32 regions will increase their benchmark premium. -

Jan, 16 2022 — The 2022 Federal Poverty Level (FPL) Guidelines determine the income level requirements for people applying for the Medicare Part D Low-Income Subsidy (LIS) program, also known as the "Extra Help" program that helps pay Medicare prescription drug costs

-

Jan, 16 2021 — On January 15, 2021, the Centers for Medicare and Medicaid Services (CMS) released the final 2022 Announcement that included the 2022 defined standard benefits for Medicare Part D prescription drug plan coverage.

Jan, 16 2021 — On January 15, 2021, the Centers for Medicare and Medicaid Services (CMS) released the final 2022 Announcement that included the 2022 defined standard benefits for Medicare Part D prescription drug plan coverage. -

Jul, 30 2020 — CMS released the 2021 low-income premium subsidy amounts (or Benchmark premiums) for Medicare Part D plans on July 29, 2020. In 2021, four regions will lower their Medicare Part D Low-Income Subsidy (LIS) benchmark premiums and 30 regions will increase their benchmark premium.

Jul, 30 2020 — CMS released the 2021 low-income premium subsidy amounts (or Benchmark premiums) for Medicare Part D plans on July 29, 2020. In 2021, four regions will lower their Medicare Part D Low-Income Subsidy (LIS) benchmark premiums and 30 regions will increase their benchmark premium. -

Nov, 06 2020 — The Income-Related Monthly Adjustment Amount (IRMAA) income brackets became inflation adjusted in 2020. Consequently, people with an annual income under $165,000 who are at the low end of their . . .

-

Mar, 07 2022 — Update 12/24/2022: 2023 BIN and PCN available at Q1News.com/989 -- see first page (E0654 - H2134), second page (H2161 - H3655), third page (H3660 - H5355), fourth page (H5372 - H7220), fifth page . . .

-

Jan, 15 2021 — The 2021 Federal Poverty Level (FPL) Guidelines determine the income level requirements for people applying for the Medicare Part D Low-Income Subsidy (LIS) program, also known as the "Extra Help" program that helps pay Medicare prescription drug costs.

News Categories

Pets are Family Too!

Use your drug discount card to save on medications for the entire family ‐ including your pets.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service